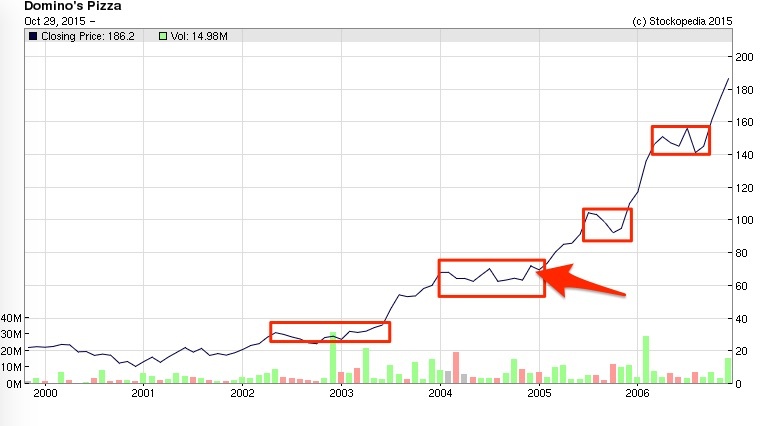

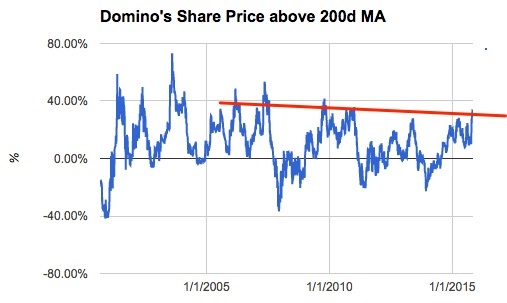

Last week Domino’s Pizza broke out to yet another stunning new high. This is a share we bought at 75p in 2004 for our family investment club and I’m proud to say we still hold. It’s now trading at 1043p per share making it a 14 bagger over an 11 year period - a 27% annualised capital return before dividends. Domino’s hasn’t just been a long term winner…. it’s been a standout performer in almost every 2 year period since it first bounced up from its lows back in 2001. Even in the last 2 years this stock has doubled in price and in all this time it’s almost never, ever been cheap. Since the financial crisis I don’t think Domino’s has traded beneath a Price Earnings ratio of 23, which begs the question of when on earth could a value investor have ever bought this share? If Value Investors admit they couldn’t then isn’t there something that they are missing?

The problem with value investing

We human beings are genetically hard-wired to look for bargains. If you can pick something up for less than it’s worth you might just have a happy outcome and a few spare pennies in your pocket to boot. It’s a strategy that works in the flea market and it works just as well in the stock market. Buying cheap is the core tenet of value investing - the strategy that has minted thousands of stock market millionaires and quite a number of billionaires too.

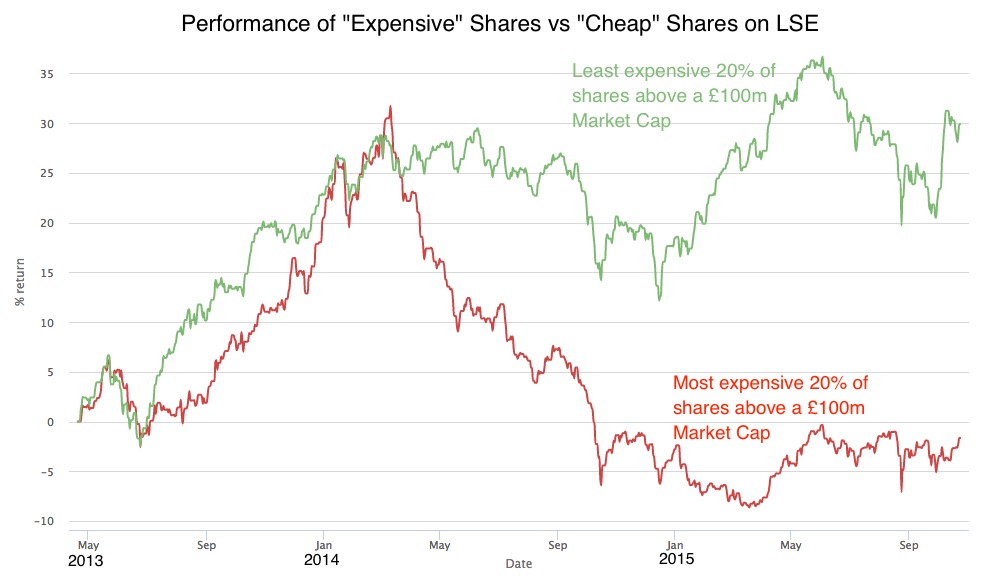

But there’s a problem at the heart of value investing which leads to a certain blindness. Value Investors have an inability to consider any stock that is even remotely pricey. Take a look at this chart and you’ll understand why.

The chart shows the performance of the cheapest 20% of the stock market (green line) vs the most expensive 20% of the stock market (red line) over the last 2 years according to the Stockopedia Value Rank. There’s about 200 stocks in each of those portfolios, but the cheap set of stocks has outperformed the expensive set by a massive 32%.

These results, from the last few years in the UK, are very typical for stock markets. Cheap shares tend to outperform expensive shares. So any rational investor, when asked to pick a winning portfolio of 50 stocks, would…