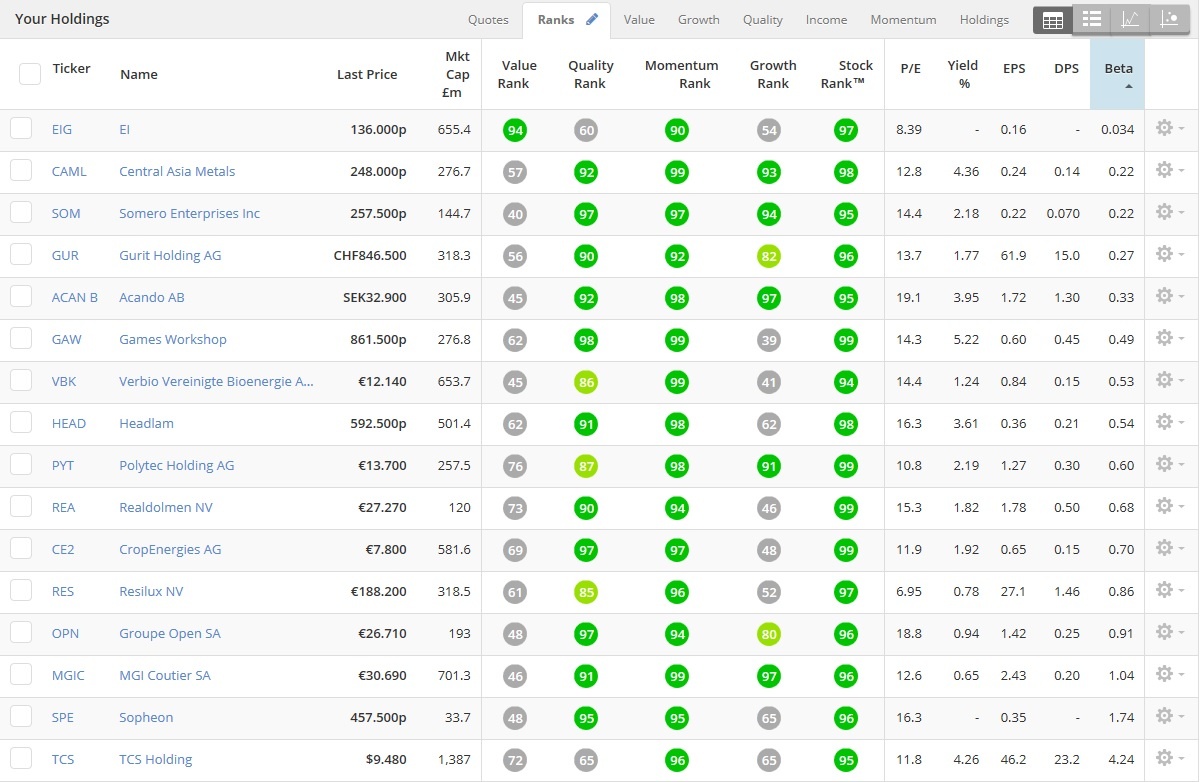

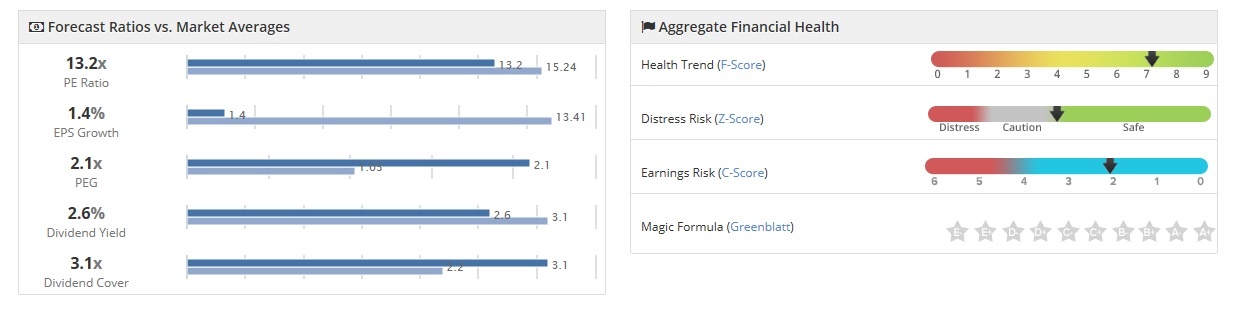

Please see attached my portfolio. The main reason for this post is to discuss the low beta impact on an otherwise potentially volatile portfolio i.e small cap and momentum.

Theory:

- Momentum >=94

- Small cap <= 800

i.e Momentum can move small caps more freely

- Stock Rank - >=94

- Quality - >= 80 (No junk stocks)

- Value (rank >= 40) Nothing too expensive

- EPS last interim greater than 0

- PEG less than <=1.5, >0

and BETA - My theory is the low beta will reduce the negative effects of momentum in a downturn.....??

I use UK and European stock which have generated this portfolio (excluding TCS and EI)