It’s well known that UK investors tend to overweight their portfolios with stocks from their home country. It’s a pattern of behaviour you find all over the world. To varying degrees, investors everywhere are prone to ‘home bias’ because of the unfamiliar nature of foreign markets. But while international investing comes with uncertainties, staying local risks having a much more concentrated portfolio than you might think.

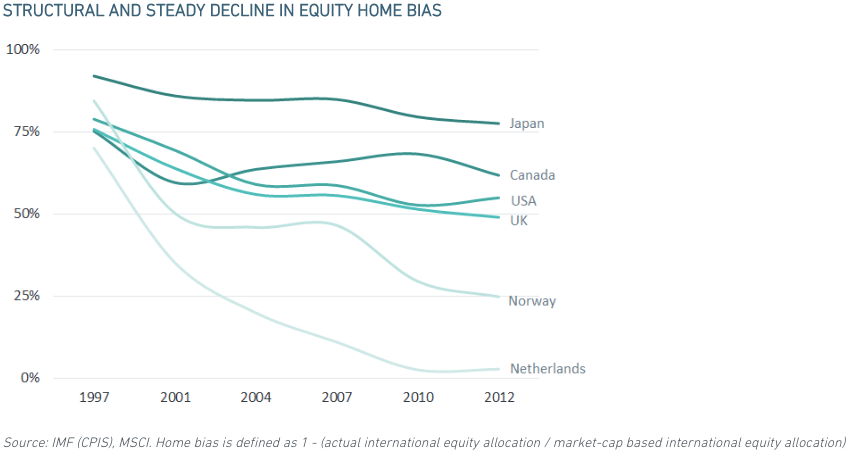

Since the mid-1990s, there’s been a notable decline in home bias. In that time, globalisation and the internet have radically improved knowledge and access to foreign markets. But according to the IMF, British investors still only allocate around half of their equity portfolios to international stocks.

On paper, that level of concentration in the home market makes little sense. After all, the UK stock market only accounts for around 8-9% of global market capitalisation. So in theory, if you wanted a fully diversified world folio, just over 90% of it would be made up of foreign stocks.

In reality though, most investors would find that kind of international weighting absurd. On one hand, it’s often argued that there’s ample opportunity to buy UK-quoted stocks with exposure to foreign markets. For instance around 77% of revenues in the FTSE 100 are derived from outside the UK.

In addition, there are several practical reasons for the resistance to foreign investing. Among them are the perceived difficulty and expense of trading (including forex fees), foreign languages, governance concerns and general unfamiliarity of companies and reporting standards. In fact, 51% of respondents to a 2015 survey of Stockopedia blamed the unfamiliarity of foreign stocks as the main reason for steering clear of them.

Potential risks of hidden exposure

Yet, while some of the deterrents to international investing are understandable, home bias may be much more risky than some investors think. New research shows that markets in some major countries have actually performed like a single sector of the world stock market. As a result, a portfolio of domestic stocks - even if appears to have broad sector exposure - could be far less diversified that you might expect.

This is the finding of Jeffrey Kleintop, the chief global investment strategist at brokerage, Charles Schwab. He looked at various country indices that are tracked by the benchmarking group MSCI and found that, far from resembling a ‘world index’, the markets of these…

.JPG)