This feels like rather a neat post to write, given the last two 'topics' - last Wednesday on Morgan Sindall, and their 'huge' returns (mostly driven by working capital management and Friday pontificating on what returns on capital actually mean for an investment. So I swing over to the other end of the spectrum, to a company arguably at the bottom of its cycle and a rather popular share with value investors - Home Retail, who own Argos and Homebase.

This feels like rather a neat post to write, given the last two 'topics' - last Wednesday on Morgan Sindall, and their 'huge' returns (mostly driven by working capital management and Friday pontificating on what returns on capital actually mean for an investment. So I swing over to the other end of the spectrum, to a company arguably at the bottom of its cycle and a rather popular share with value investors - Home Retail, who own Argos and Homebase.

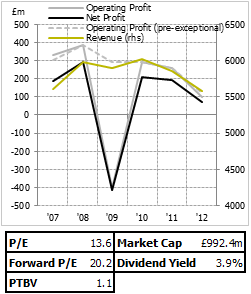

I say 'bottom of its cycle' as a current and more forward looking thing, really, because one thing that did surprise me when looking at the company's accounts was how well it held up during the recession in general. Apart from a big asset writedown, as you can see on the graph, profits have actually held up rather nicely. It was only 2012 that saw that figure dip heavily, but forecasts are for a continuation of that - these very weak figures - instead of any return to their profit in, say, 2010. Which course of events is more likely?

I consider Home Retail more of a 'bigger picture' investment question. As far as I'm concerned, there's a sort of investment continuum between risk - there's companies whose primary risks are more idiosyncratic, and rooted entirely in how that specific business operates, and there's companies whose performance is determined more by market forces. Of course, no-one can escape market forces - but take something like Communisis and compare it to Home Retail and you'll see what I mean. The latter is a huge part of the general retailing market, and as such is primarily driven by general consumer confidence. This makes company specific trends more difficult to interpret. The first is facing a market of uncertain potential size, with a relatively new offering of services.

There's two primary questions I'm concerned with relating to Home Retail, and they're (as always) interrelated. The first is probably the most obvious - it's clear times are rough for the consumer, but how much of the downturn is cyclical and how much of the downturn is secular? I can't remember the last time I bought anything from Argos. I use other internet retailers (nearly always Amazon) for almost everything. On the other hand, when was the last time I bought…

.png)