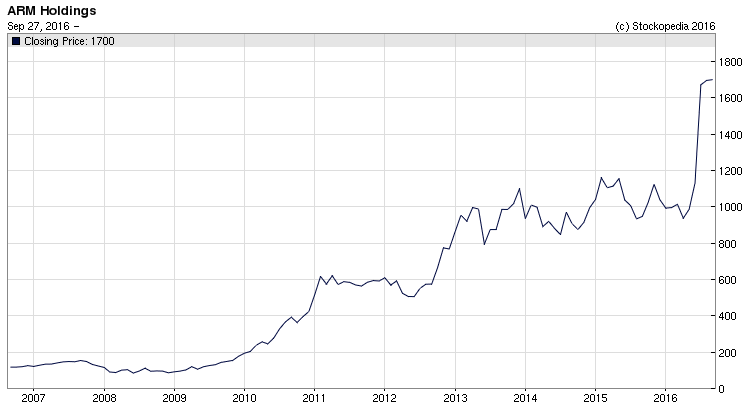

When Japanese telecom giant SoftBank wrapped up the takeover of ARM Holdings recently, it marked end of British ownership for one of the country’s most successful technology companies. For outgoing shareholders, the deal was bittersweet. ARM delivered fantastic gains over more than 10 years, but it was the type of buy-and-hold stock that promised much more to come. For those investors forced to cash out, the question now is how to find stocks that fit the same sort of investment profile.

Eight years ago, 1,000 shares in ARM would have cost around £1,100. On the takeover by SoftBank, that investment would have grown to £17,000 before costs and dividends. The company’s growth is down to a successful model of developing intellectual property for chips that are used in a huge number of devices. Its customers include some of the biggest names in technology, like Apple and Samsung.

How ARM stacked up as an investment

Looking back, one of the key investment ingredients that made ARM attractive was its quality. Over the past five years, its earnings grew at a compound annual rate of around 30%. Plus, there were strong signs of it becoming more and more profitable. Its operating margins were just over 40% last year and its return on capital employed, was close to 21%. These were sector-leading and market-leading performance figures, and both were on upward trends. On this basis, at least, it was the sort of investment Warren Buffett might suggest was worth holding forever.

Another major factor with ARM in recent years was its positive momentum. A major re-rating came between 2012 and 2013 when the price doubled to more than 1000p - a level where it traded for the following three years. But its consistent ‘earnings momentum’ attracted regular forecast upgrades from brokers, which were eye-catching for prospective investors… including SoftBank.

As a result of its high quality and robust momentum, ARM rarely looked cheap on the usual valuation measures. It was a high flyer that demanded a premium from buyers of its shares. In return they got part-ownership of an exciting, high-growth technology leader. It was even paying a modest dividend that was consistently growing.

Screening for another ARM

There are few obvious replacements in the technology sector that match ARM’s investment profile in the UK market. But cast the net wider, and it’s certainly possible to find high quality, positive momentum large-caps…