The Stockopedia StockRanks are proving more and more popular, not only as a stock picking guide but also as an educational framework to what works in investing. One of the main goals of the system was to be able to rank every stock in the UK market, regardless of sector or stage of their business cycle, while aligning the site closely with the key findings of academic finance. The exceptional performance of the ranks since launch has surpassed even my own expectations, but their growing influence does mean we have a responsibility to help subscribers understand, and not misuse them.

This post I hope will go some way to clarify how to 'think' about the StockRanks.

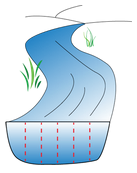

Never cross a river because it is on average 4 feet deep

One of my favorite of Nicholas Nassim Taleb's maxims is that you should "never cross a river because it is on average 4 feet deep". Nicholas Nassim Taleb, as a derivatives trader and the author of "Fooled by Randomness", has an understanding of probability that goes much deeper than most. What he meant was that while averages are extremely useful, they can be dangerous as they don't give any indication of the underlying variability of a distribution. In simple terms, there's a big difference between crossing a river you know is consistently 4 feet deep, to crossing a river that is generally 2 feet deep but has occasional yawning 10 feet deep pools.

One of my favorite of Nicholas Nassim Taleb's maxims is that you should "never cross a river because it is on average 4 feet deep". Nicholas Nassim Taleb, as a derivatives trader and the author of "Fooled by Randomness", has an understanding of probability that goes much deeper than most. What he meant was that while averages are extremely useful, they can be dangerous as they don't give any indication of the underlying variability of a distribution. In simple terms, there's a big difference between crossing a river you know is consistently 4 feet deep, to crossing a river that is generally 2 feet deep but has occasional yawning 10 feet deep pools.

This analogy really helps when thinking about the StockRanks. A stock that is ranked 90+/100 scores extremely well across the three key drivers of stock market returns - quality, value and momentum. Historically, over most multi-year time periods, stocks with these characteristics have on average tended to outperform the market. But individually they have zero guarantee of outperforming.

Monkeys with darts

There is an old game in the stock market where brokers give their best picks to the press and go head to head with a monkey throwing darts. The monkey invariably wins. If we took our monkey and asked him to throw darts at high StockRank stocks how would he have done?

To answer this, lets go back and look at the performance of the set of top ranking (90+) stocks on LSE since launch in April 2013. Excluding the tiddly microcaps with a…

To answer this, lets go back and look at the performance of the set of top ranking (90+) stocks on LSE since launch in April 2013. Excluding the tiddly microcaps with a…