During the late 1960s a young Canadian city analyst called David Dreman lost much of his personal wealth by investing in glamour stocks. Ten years later, he was running his own investment firm, which at its peak was handling $22bn of client cash. Learning from his early experiences, Dreman developed his own brand of contrarian investing, throwing out conventional wisdom and looking for shares that nobody else wanted. It’s a philosophy that made him a wealthy man and continues to have a major influence on investors.

Losing money in popular shares led Dreman to focus on finding value in the market by deliberately acting against the herd. He wanted out-of-favour stocks in beaten down sectors where they could be snapped up on the cheap. He judged that other investors would often overlook these opportunities and that, over time, his shares would be in the money. To find them, he concentrated on the cheapest 20% of stocks in the market based on metrics like price-to-earnings (PER), price-to-book and price-to-cash flow. He also put a major emphasis on stocks with above average dividend yields. For added protection, Dreman employed rigorous fundamental analysis, avoiding the smallest companies and looking for signs of earnings growth and financial strength as well (you can read more about the strategy here).

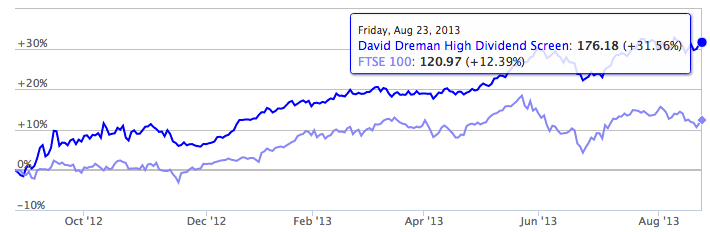

In his book Contrarian Investment Strategies, Dreman advised investors to do away with the traditional tools of ‘overly optimistic’ broker forecasts, technical analysis and ‘timing’ the market. Instead, he suggested that being realistic about the potential downside of an investment, being patient and avoiding highly priced shares were more important. At Stockopedia we track four Dreman-inspired screens using different valuation measures and some of them are producing interesting ideas, particularly the David Dreman High Dividend screen, which has returned a strong 31.1% over the past 12 months.

The dividend strategy focuses on the top 20% highest yielding stocks in the market with strong financial health and growth characteristics. Among those in the current portfolio (and still qualifying for the screen) is Russian gold producer Highland Gold Mining (LON:HGM) , where Roman Abramovic’s Millhouse Capital is a major shareholder. Well publicised falls in the price of gold have done no favours for quoted mining companies over the past 12 months, including Highland, even though the company’s net profits were up by…