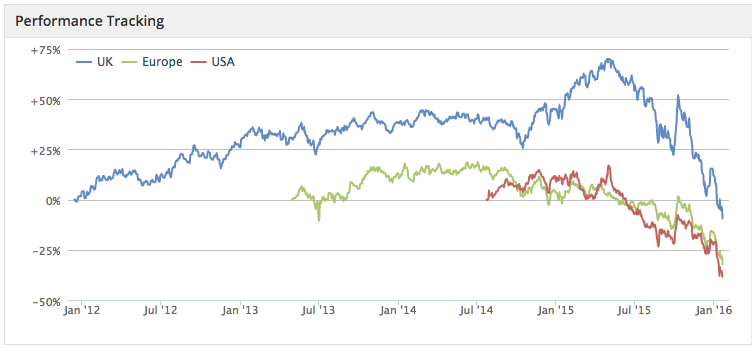

Dividend strategies occupy a unique space in the stock market. Unlike most investing styles, they generally prioritise the yield on a share rather than pinning all their expectations on a rising price. Part of the attraction of this approach is that it can help to ride out bouts of market volatility. If the market dips and prices fall, the dividends from those shares should largely stay intact, and the yields may even rise. But that’s not to say that dividend strategies are entirely immune from market falls. A number of the nine guru-inspired income models tracked by Stockopedia undershot the market over the past year, and the worst performer was one of the most popular strategies around - Dividend Dogs.

Dogs in more ways than one

Dividend Dogs is a strategy that buys a basket of 10 of the highest yielding stocks in the blue chip FTSE 100 index. It was originally introduced by Michael O’Higgins and John Downes in the early 1990s as a way of picking high yielding shares from the Dow Jones industrial index. It’s a strategy designed with simplicity in mind. The main safety net is that high yielding blue chip stocks tend to be mature, stable businesses that don’t often pull shocks on their shareholders. Things can go wrong of course, as investors found during the financial crisis when the otherwise reliable bank dividends were slashed.

Part of the problem with the Dogs strategy, particularly in the UK, is the limited ability to diversify. Hunt around for high yields in the FTSE 100 and you’ll frequently bump up against oil giants, miners, supermarkets and financial stocks. And this is where the problems started in 2015. The quarterly-rebalanced Dividend Dogs portfolio regularly held stocks like BP, Royal Dutch Shell, BHP Billiton, Tesco, Wm Morrison, HSBC and Aberdeen Asset Management. Many of these shares performed badly in 2015, driving the strategy’s performance over the past year to a shocking return of -34.8%. That compares to 6.3% in 2014.

As a result of falling valuations in parts of the FTSE 100, the yields on offer have improved. The current batch of 10 stocks qualifying for the strategy offer a median yield of 9.4%. At the close of 2014, the figure was 6.3%, and a year earlier it was…