Runaway pension deficits have long been a problem for equity investors. In this age of low interest rates and long lived work forces the problem is exacerbated further still. Many plans now struggle to earn the returns they need to stem the flow of operating profits into the so called ‘pension black hole’. Many investors have stressed the impact they can have so it is important that we have a way of assessing them.

As you (hopefully) all know by now, at Stockopedia our mission is to take the pain out of this kind of process so we’ve come up with a new set of ratios to make this as easy as possible for you. So, allow me to introduce...

The New Pension Deficit Ratios

Pension Deficit

What does it tell me?This is simply the value of the pension deficit or surplus on the company’s group level balance sheet. A positive value indicates that there is a deficit - i.e., that the pension is underfunded. A negative value therefore indicates the opposite - that there is a surplus.

A neat trick with this metric in the screener is to combine it with other ratios via the ‘Ratio vs. Ratio’ rule builder. This allows you to compose your own pension deficit ratios and compare a deficit against sales or tangible assets, for example.

How is it calculated?It is quite simply the value of the deficit or surplus as displayed on the company balance sheet.

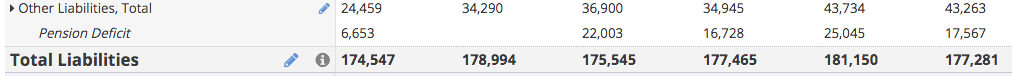

Where can I find it?You can find the metric in the screener under the name ‘Pension Deficit’. You can also find this figure on our balance sheets as a component of ‘Other Liabilities, Total’:

Pension Deficit to Market Cap

What does it tell me?This metric is intended to give a sense of the scale of the pension deficit relative to the market capitalisation of the company. Due to the seniority of pension liabilities over other forms of debt and equity, a large pension deficit can prove especially troublesome for equity investors.

If there is a deficit, then it must be paid off somehow and there are only two options available to a company. Either sufficient returns are earned on plan assets to close the gap, or contributions are made from operating profits at the expense of shareholders. Generally, the latter of these two options is how things play out so it is critical to keep an eye out for an oversized deficit.

This ratio…