The FTSE 100 (UKX) has had another good year so far, up more than 15% including dividends. From the lows of March 2009 its total returns have been more than 100% and some investors have started to get nervous. The “wall of worry” is as good a description as any; the higher the market goes, the more investors worry; but are they right to worry?

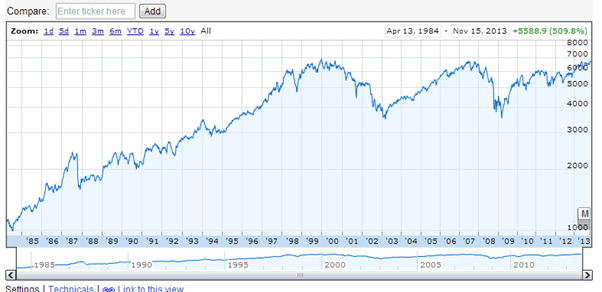

Let’s have a look at a chart of the FTSE 100, courtesy of Google Finance:

Here we can see that over the past 30 years the FTSE 100 can be split into two halves – The happy days of the 80s and 90s where the market went up with very little volatility (except the market crash in 1987), and the much less happy, sideways bouncing years that we’ve had since 1999/2000.

From this chart it seems that there is an invisible barrier at 7,000. Perhaps this is some natural limit that the stock market simply cannot pass? I don’t think so.

The index’s price level is only half the story

The problem with looking at the market in this way is that all we can see is the price. It’s like me asking you if you want to buy a car for £10,000, but not telling you what car you’d be buying.

If it’s a brand new Rolls Royce Phantom then you’re getting a good deal, but if it’s a 1988 Ford Sierra then perhaps the deal is not so good.

We need to see some information about what exactly we’re buying when we buy the FTSE 100. Of course what we’re buying is a group of 100 companies, but we don’t even particularly want the companies, what we want is a piece of their profits and their dividends.

Along with the price of the FTSE 100 (its index level) we also need to look at its earnings, and specifically its smoothed earnings. Smoothed earnings remove most of the effects of the business cycle, whose short-term ups and downs just confuse matters.

These smoothed earnings are most commonly measured using CAPE (Cyclically Adjusted PE), which is the ratio of the price to the average inflation adjusted earnings of the past decade.

The chart below overlays the price of the FTSE 100 with a range of CAPE values so that we can see where the market is, in…