Unless it is a market capitalisation tracker fund, that perfectly matches, the index any portfolio will lead or lag the returns of the index it relates to. One way to quantify this difference is a measure called beta which is an expression that quantifies the volatility of the portfolio relative to the benchmark. A figure of one means it has the same volatility as the index, less than one that it is has lower volatility and a figure greater than 1 that it is more volatile. In other words, a portfolio that has a beta higher than one can be expected to rise more in bull markets and fall more than its index in bear markets while a portfolio rated less than one should give a smoother ride.

In practice, beta is rather a crude measure and does not really equate to an assessment of the bias a portfolio might have to growth or value. In theory, a portfolio with more growth stocks would have a beta higher than one while one with more value stocks would be expected to have a beta lower than one. Bear in mind too that traditional indices have an in-built bias toward growth stocks because they are weighted by market capitalisation which is more a measure of popularity than of any financial aspect with a direct relationship to the company.

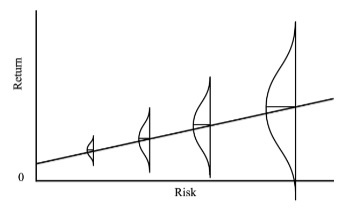

Academic theory tells us that there should be a good correlation between risk and reward, and at a basic level there is; if held long enough equities give higher returns than bonds which in turn give higher returns than cash. Many commentators extrapolate this to differences within asset classes and postulate that higher risk securities give better returns than lower risk ones. Indeed much academic work has gone into bolstering this theory and it has become widely accepted. If this is correct, any bias away from the index should be towards higher beta, i.e. higher risk stocks, to get better long-term returns. Indeed, many active funds tend to overweight small and mid-cap stocks to increase their risk profile in the hope of higher returns.

Except that it is not true.

An excellent paper in 2012 by Baker and Haugen demonstrated very powerfully that in fact lower risk securities, in both bonds and equities in 21 developed and 12 emerging markets, gave better returns…

"Academic theory tells us that there should be a good correlation between risk and reward, and at a basic level there is"

I actually prefer Ben Graham's interpretation of risk and return (from "The Intelligent Investor" ) as opposed to Academic Theory:

"There has developed the general notion that the rate of return which the investor should aim for is more or less proportionate to the degree of risk he is ready to run. Our view is different. The rate of return sought should be dependent, rather, on the amount of intelligent effort the investor is willing and able to bring to bear on his task".