December 2014

Background

Despite a decent “Santa rally" which got underway mid-month it was not enough to erase the earlier losses. Russia, -19.9%, was again the worst performing major market with the collapse in the oil price taking its toll. Continental European markets were generally weak as worries about sagging growth and deflation grew and the spectre of Greece leaving the € raised its ugly ahead again with a general election set for January 25th; Italian MIB -5.0%, Spanish IBEX-4.6%, French CAC -2.7% and German DAX -1.8%. China was the best performing market, +7.1% and the US S&P 500, despite closing at another all-time high on 29th December closed the month down 0.42%. In the UK the FTSE All Share (Total Return) Index fell 1.6% during the month but did manage, just, a positive return for the year as a whole of +1.2%. The Japanese Nikkei and the US S&P 500 both recorded positive returns for the year, +7.1% and +11.4% respectively but someway short of the +19.5% return from China and +29.4% from India.

JIC Performance

The JIC Portfolio finished the year in good form rising 1.1% in December and recording a return of 11.1% for the year as a whole. Since inception three years ago the JIC Portfolio has achieved a total return of +90.5%, nicely ahead of the +37.3% return of the FTSE All Share.

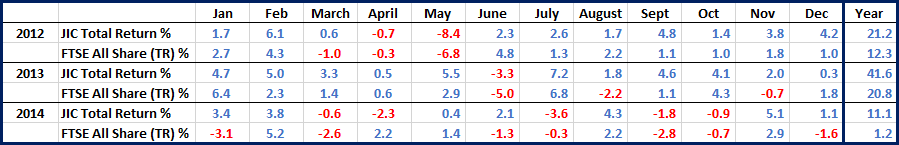

Monthly Returns for the JIC Portfolio and the FTSE All Share (Total Return) Index since January 2012:

The top performer during December was Crawshaw, +17.8%, benefiting from the announcement of the appointment of a new chief executive to oversee the national rollout of the business. AdEPT Telecom was up 11.7% following November's strong results and the commencement of a share buyback by the company. DixonsCarphone, +9.2%, published a maiden set of interim results following its merger earlier in the year, which showed strong growth across the business and lead to earnings upgrades for the full year. Polar Capital, -12.9%, was the main drag on performance with some disappointment at slightly higher than anticipated costs in the first half.

Crawshaw and DixonsCarphone were strong contributors over the year as whole, up 203% and 70.6% respectively; in fact DixonsCarphone was the best performing stock in the FTSE 100. Other notable stocks held throughout the year were French Connection +66.1%, Biotech Growth Trust +44.9% and Worldwide Healthcare Trust +38.3%. Polar Capital, which is down 10.8% on my purchase…