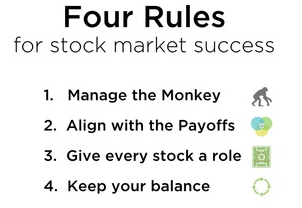

On our journey to build the very best data service and toolbox for investors, our team at Stockopedia has developed an investment philosophy. It’s obvious that investing is a very personal business; everyone is driven by different aims, timeframes and risk appetites. But we believe that getting to grips with a set of four broad principles can set investors on the right path to outperformance, and help them avoid the most common mistakes.

The first three principles in the Stockopedia philosophy focus on self-management and portfolio construction. Firstly, by managing the monkey, we begin by admitting the behavioural flaws which lead to bad decision making (from overtrading to hanging onto losers) and how we can put in place a process to combat them.

Secondly we focus on ensuring our stock selections are aligned with the factors that have pay off in stock markets (quality, value, momentum). Thirdly we make sure our resulting portfolio is adequately diversified across those selections - to ensure the portfolio plays well both in offence and defence.

The fourth and final rule - and the focus of this article - we call “Keeping your Balance”. Keeping your balance means taking a regular, cyclical and proactive approach to portfolio management to ensure it is well defended against the vagaries of the market. Crucially, it’s a reminder to avoid letting emotions guide decision making or allowing the portfolio to drift away from its intended objectives.

Weighting - keeping your portfolio in proportion

Deciding what proportion of a portfolio each stock should take is very much down to whether you’re a stock market hunter or a farmer. Stock picking hunters tend to apply detailed bottom-up analysis to each share. Depending on their conviction, they’ll weight their exposure to it accordingly. This is perfectly acceptable if you are very confident in your analysis.

On the other hand, farmers tend to construct portfolios of shares that aim to harvest factor returns. Decades of academic and professional research show that these main drivers of returns are oriented around quality, value and momentum. But what weight should each holding have?

Traditional UK benchmarks like the FTSE 100, the All-Share and the FTSE SmallCap are weighted by market capitalisation. In essence, this means that larger companies have a proportionately higher weighting than smaller companies. For many funds, particularly trackers that use these indexes as benchmarks, it makes sense to do the same as…