The insurance and savings firm Legal & General (L&G) has a 5% forecast dividend yield for 2015 which rises to 7% by 2018. The ageing population is a key driver as it encourages saving and boosts demand for retirement products. These trends suggest that L&G's shares offer an attractive savings vehicle.

Investors in financial shares sometimes compare the dividend yield they offer to the interest rates on their financial products. In the current low interest rate environment it is almost always the case that the shares offer higher payments.

Clearly equity investments have the risk of capital loss and so the comparison is somewhat unfair. However, Legal & General has rebounded strongly from the global financial crisis which suggests that the business is resilient.

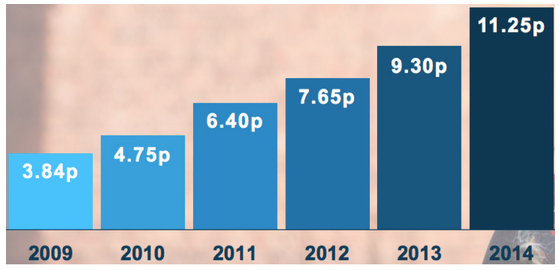

In 2007 the group paid out a yearly dividend of 5.97p which it then cut in the following two years to 3.83p in 2009. Since then the annual dividend has growth at rapid pace and hit 11.25p in 2014.

Legal & General's dividend rebounds

Source: Legal & General investor presentation

The net cash dividend cover has fallen from 2.72 in 2010 to 1.65X in 2014. Subject to solvency II requirements the group expects to reduce its dividend cover to 1.5X in 2015.

Future dividend growth will be driven by the underlying business as dividend cover can only fall so far. Legal & General has a “progressive dividend policy" which is supported by the tailwinds for its key divisions.

L&G's divisions

L&G Assurance is the largest profits generator and provides life insurance, general insurance and savings plans. The division benefits from the need for individuals to save more and buy protection products as the state retrenches.

Longer lifespans and the cut back in defined benefit pension schemes have driven a retirement savings gap. In response the UK government has introduced automatic workplace enrolment into pension schemes.

The second biggest division by profits contribution is Retirement which sells annuities. Demand for individual annuities has been hit by UK pension freedoms but corporate demand is robust demand as firms de-risk defined benefit schemes.

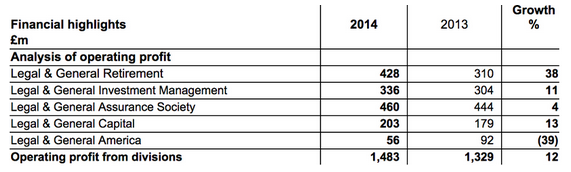

Assurance generated 31% of L&G's operating profit in 2014 while Retirement came in at 29%. Assurance saw modest 4% profits growth in 2014 but Retirement saw 38% growth despite individual “pension freedom" reforms.

L&G's divisional profits in 2014

Source: L&G investor update

Investment Management is the third largest division by operating profits at 22.6% of…