Summary

Lonmin’s share price: 24p/share. Market cap: £142m.

Conclusion: There are three main ways Lonmin’s fortunes can go, and they’re:

1. Administration; - probability 85%.

2. Banks extending lending facilities – probability 12%.

3. Raising cash from existing or new shareholders – probability 3%.

For more details, read below.

Brief profile

Lonmin is the third biggest miner for Platinum (a metal even rarer than gold); it also mines related metals to platinum known as PGMs that include palladium, rhodium and ruthenium in South Africa.

Outside of PGMs, they also mined gold, copper, and nickel, but these accounts for less than 15% of total sales.

Lonmin is regarded as a platinum miner because platinum accounts for 69.5% of total sales.

Unlike other metal producing miners, its share price has collapsed to oblivion.

The share price has dropped by 98% in value since 2011, so long-term investors have lost everything! Even if you invested last year, your Lonmin’s portfolio would still saw a loss of 83%!!

So, what befell Lonmin?

The problems with Lonmin

1. Back in 2012, a protest from Lonmin’s employees on pay and conditions has left 46 people dead.

There were further protests in 2014, where strikes lasted for five months.

2. Operationally, the company continues to take on new debt. In their interim report 2015, net debt stood at $282m at the end of March 2015.

Net debt in the future LIKELY to rise further because Platinum prices have fallen by a further 16% and Palladium dropped another 23.4%.

Hence, why the share price has collapsed because investors’ expectations are Lonmin will issue more shares.

3. Like all other miners, Lonmin has suffered from falling commodities prices.

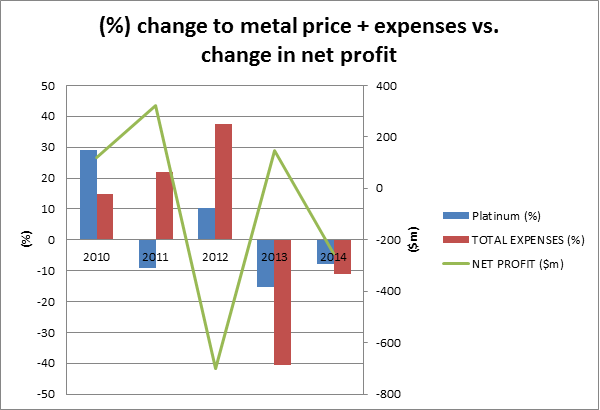

The fluctuation in metal prices and big swings in its total operating costs have not helped the company’s management to set definitive goals to meet company’s objectives. (See below)

Big changes have caused the business to report ‘big’ net profits in one financial period and ‘big’ net losses in another. This cause management confusion in whether to be conservative (conserve cash) or spend to expand the business.

4.Glencore, a commodity trading company, owns more than 24% of Lonmin decided to sell all of its shareholdings. That added more supply of Lonmin’s shares in the market, putting further pressure on its share price.

5. Since 2010, the company has repaid a total of $1,754m in borrowings but took out $2,511m in new borrowings.

For those ordinary shareholders, the company paid out $94m in dividends to…