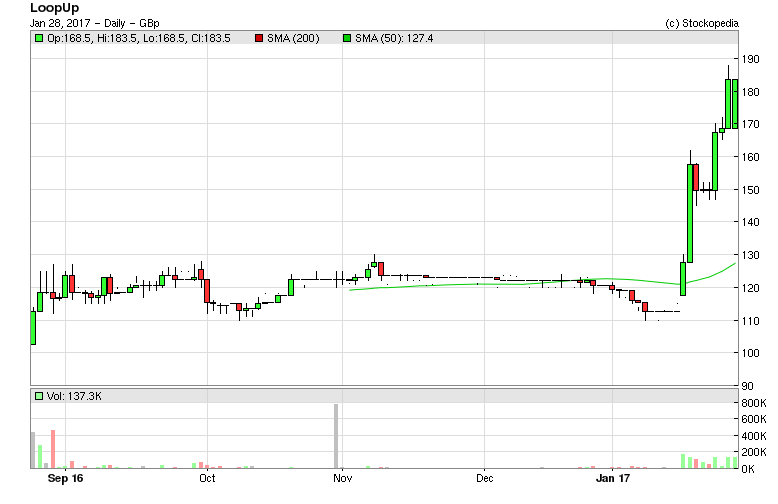

LoopUp (LON:LOOP)

Share Price 167.5p (up 12% today)

Bid/Offer 165p – 170p

Market Cap £70.9m Enterprise Value £81.2m

Normal Market Size 1,500

About the Company

LoopUp (LON:LOOP) came to the market in August 2016 priced at 100p. The share has risen nearly 67% on better prospects recently announced by the company.

Loop Group plc is a standard conference call technology firm which started in business back in 2006. The company was loss-making for many years at the net profit level, with the first profits expected at this year-end.

The Product

The typical LoopUp meeting gives the call conferencing organiser the .......

• Ability to create a meeting and invite directly from Microsoft Outlook in two clicks

• A ‘call start alert’ to their desktop and mobile/tablet devices as soon as their first invited guest joins the meeting

• The real-time readout of all guests on the meeting,

• LoopUp calls out to the guests on the phone of their choice when they are ready to join, rather than requiring them to dial in with access codes

• Ability to identify who is speaking at any given moment

• Ability to identify who has distracting background noise and mute their line

• For larger meetings, ability to put all guests on mute

• Ability to click-to-record, on demand

• Ability to quickly and easily share their screen with guests at any moment, during any meeting, with a single click of a button

• Ability to allow other guests to share their screen at the host’s discretion

Valuation

Can the company justify the current valuation is the question? A few days spent mulling over the facts has left me uncertain whether to buy or ignore the stock altogether. Dare I risk it? Certainly, the company's current p/e over a 100 would give an investor a nose bleed. The market cap is at least 6 times sales revenue.

The Positives

The Group does have high recurring revenue growth. The revenue from the LoopUp product was £9.2 million out of the Group's total £10.1 million in FY2015. LoopUp is primarily sold on a pay-as-you-go basis, while a monthly subscription is also an option.

The company claims to have 35%+ growth in revenue with similar growth expected next year. Growth has been continuous for last sixteen quarters. This may give a more reasonable valuation on a forward p/e for a growth stock.

The company has the ISO…