IBTimes Video Link (click below):

Edmund Shing: Make money from a strong pound at Marks and Spencer and Majestic Wines

This week, pound sterling hit its highest level against other major world currencies for over seven years (figure 1), judging by the Bank of England's Pound sterling index.

Figure 1: Trade-weighted pound back at highest since mid-2008

Source: Bank of England

This latest surge has been driven by the political certainty given by a Conservative general election victory, plus a following wind for the UK economy as:

- Unemployment continues to fall

- Retail sales surge higher (+4.7% year-on-year in April 2014)

- The domestic property market resumes its upwards march.

Pound posts big gains against the euro and Aussie dollar

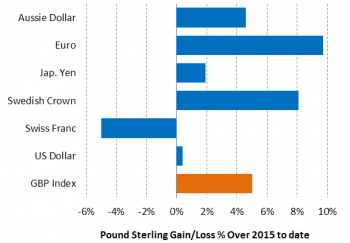

Of the major world currencies, the pound has gained against virtually all of them so far in 2015, save the Swiss Franc (figure 2).

Figure 2: Pound makes big gains against the euro and Australian dollar in 2015

Source: Bank of England

The biggest move has been the near 10% jump against the euro (from €1.29 at the beginning of 2015 to €1.41 currently).

The pound has also posted useful gains against the Australian dollar and Swedish crown too, with only the Swiss franc doing better this year so far.

Why should sterling stop here?

As long as the British economy keeps steaming along and the European Central Bank continues with its programme of bond buying (so-called Quantitative Easing, or QE), we could well see sterling return to the heady heights of €1.50 reached on several occasions between 2004 and 2007 (figure 3).

Figure 3: Pound hit over €1.50 several times 2004-07

Source: Bank of England

After all, the euro remains undermined by the ongoing Greek saga, while the extremist leftist party Podemos has made large gains in the local elections in Spain, underlining the political fragility of the established ruling parties across the eurozone and introducing yet further uncertainty.

Remember, if there is one thing financial markets hate, it is uncertainty – one area where the UK has a clear lead over its continental European cousins with a Conservative majority government now voted in.

How can we make money from a stronger pound?

One sector a canny investor should look at is the…