I genuinely do sympathise with anyone who started investing in stock markets for the first time in January 2016. It's not been an easy environment - but let’s get one thing straight it’s not exactly been bad. If you've invested through 2000 and/or 2008 you'll know what bad really is and it’s much, much worse than it is now. The year to date return for the FTSE 100 is a 4.4% fall, which is pretty much on par with last year’s lame showing and perfectly in the range of normal for stock markets. From comments on the Stockopedia.com website it’s been clear that many investors are nursing losses worse than this and with all the recent uncertainty over Brexit they are wondering what to do. What’s going to happen next? Well I’ve learnt the futility of forecasting so can proudly say I have absolutely no idea, but I do know what’s happened in the past and while history never repeats, it often rhymes. So let’s read the rhyme.

FTSE 100 return history

In my database I’ve got FTSE 100 price histories back to 1984. That’s a period that covers 2 massive bear markets and one of the longest bull markets in history. It’s not long enough for a complete analysis, but it’s probably a pretty good proxy for what happens in the stock market in general. I don’t like the FTSE 100 as an index at all, but it’s the UK bellwether and widely followed so it’s a good enough place to start.

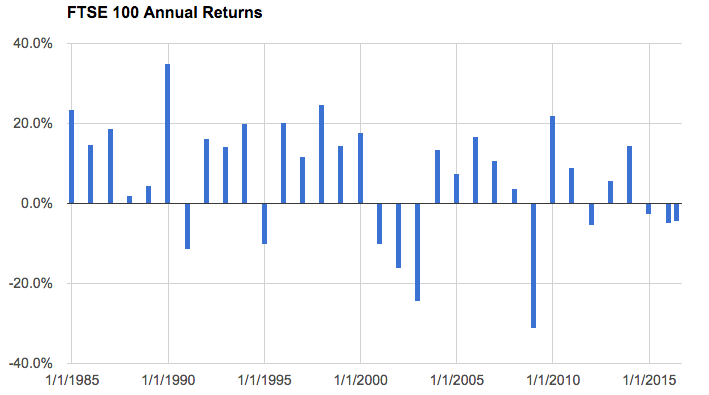

The image below shows the annual percentage return each calendar year since the end of 1984. As you can see it’s a picture that shows lots of positive years interspersed with some vicious setbacks.

The FTSE has returned an average annual return (excluding dividends) of 6.7% per year in this period and the standard deviation from the average is 15% annually. So in a typical year the FTSE has returned anything between a loss of 8% and a gain of 22%.

In this 33 year period there have been 23 up years and 10 down years. The average investor in FTSE stocks will have seen a gain year on year around two thirds of the time. Below is a histogram of the returns which helps us visualise the distribution. The height of each column in the histogram is the number of years that have…