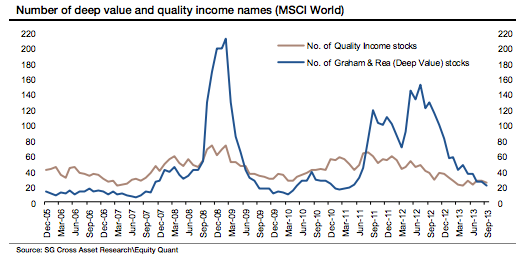

We've had the odd side discussion on market timing recently so I thought it an apt time to start a thread with the aim of catalysing some further discussion. One of my favoured metrics is the number of stocks that qualify for favorite screens. I've noticed that e.g. the Zulu Principle screen on Stockopedia is severely lacking in candidates (only 7 qualify vs 25 a year ago. There's also more evidence of frothiness from a recent Soc Gen research note which showed the number of Ben Graham Deep Value candidates in the MSCI World index is getting a little low...

As you can see from the chart above - the market can chug along quite happily for years without a serious correction while there are no bargains about, but it's still food for thought that valuations aren't offering nearly as much upside as they were a year ago.

As John Rosier has noted, there's no reason to be alarmed or do anything while the market has momentum and especially while your stocks are behaving nicely in solid uptrends, but for investors that are new to the market it's unlikely there will be anywhere near the returns going forwards as we've had recently.

If anyone wants to add their thoughts please do. We are going to be building a market timing / valuation module (and I do have a bunch of ideas) but I wanted to scratch the communal brain and see what falls out.