Sentiment Changes from Greed to Fear.

The Dow Jones index fell 394 points to 18,085 on Friday. This seems to have been caused by the simple timing issue of a USA interest rate hike. The market is now giving increased likelihood of the rate hike occurring now in September versus December. The stock market's knee-jerk reaction on Friday was at face value unwarranted. Something else is happening in the minds of investors.

Stock markets in previous months had cast aside more worrying stock market news with no material shift in stock market indices. Hence the low volatility. The market is now whispering in my ear that the market is particularly more noise sensitive to financial news than normal.

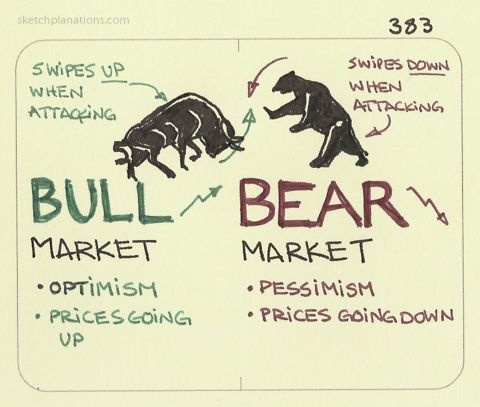

I suspect that any future negative financial news will have a bigger effect on UK, European, and USA stock markets than would have been anticipated, catching market participants by surprise. Wild swings in different stock market indices will reverberate around the world confirming a bearish outlook. Financial experts will continually worry us when discussing negative news and sometimes even be negative on apparent positive news.

My own cash build-up from stock sales over the last few months while initially prudent. has become painful as the market continue to rise another 5 - 10% . A mild stock market correction won't see me rewarded for my bearishness. Moreover, a 20% fall in the stock market over a series of weeks will see me undone once again, but this time on the downside having bought back into the market too early!

Timing the market is really impossible so why try? Why do I continue to try? It is far much better to play the game virtually 100% invested, with money only temporarily withdrawn to crystallise gains. This also gives the chance to chase other more profitable trading opportunities for some out-performance.

The fear of substantial loss simply holds too many investors back, because the idea of losing is far worse than the elation of a capital gain. They buy when the market is high and sell at the bottom. Bulls don't mind having the occasional setbacks as long over the long run capital gains are maximised. Setbacks and market corrections are just further opportunities just to buy that bit cheaper.

The Bull factors include.....

Interest rates continue to remain low for a decade or so.

Let's presume that entire overall markets…