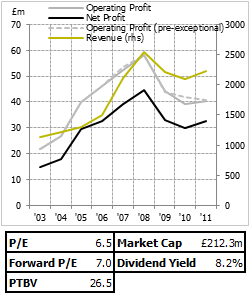

A relatively short one on the conundrum posed to me by firms like Morgan Sindall (LON:MGNS) . There's no shortage of them hanging around the cheap end of the market at the moment, either, with Kier being an obvious comparator that interested me a while back. They're basically construction groups with a service element, which makes them attractive for big projects, and means they have clear public sector links. About half of Morgan Sindall's work comes from the public sector. This is probably dragging on the sentiment for the shares, but that might be for good reason; though at least a little part of me thinks that Government infrastructure spending might become more in vogue in the near future.

A relatively short one on the conundrum posed to me by firms like Morgan Sindall (LON:MGNS) . There's no shortage of them hanging around the cheap end of the market at the moment, either, with Kier being an obvious comparator that interested me a while back. They're basically construction groups with a service element, which makes them attractive for big projects, and means they have clear public sector links. About half of Morgan Sindall's work comes from the public sector. This is probably dragging on the sentiment for the shares, but that might be for good reason; though at least a little part of me thinks that Government infrastructure spending might become more in vogue in the near future.

So here's the - sort of - 'discrepancy'. When I first looked at these businesses I marvelled at the margins. Morgan Sindall makes less than 2% operating margin. Gross margin is more like 10%. If I put myself in the shoes of one of the managers who is trying to figure out the cost/benefit of a contract that I'm tempted to bid for, those seem like awfully fine lines to me! It's tempting for me to think something along the lines of 'how much thinner can margins reasonably get? Isn't there a baseline level?'. I'm not sure of the truth or otherwise in this way of thinking. Certainly there's no economic reason to think that margins should have a baseline, floor level, but psychologically speaking maybe the idea is a little more powerful.

With ultra thin margins, though, come huge economic returns. Returns on capital are enormous. If I define capital as property, plant and equipment + working capital + capitalised lease obligations, and consider all £109m of cash on the balance sheet as a part of working capital (i.e. not excess, though this is probably a reasonable assumption here), I get return figures of upwards of 40% for the last few years. The increase over the 20% seen pre-recession is mostly down to the huge improvements to working capital, which has turned negative as Morgan Sindall have presumably squeezed their suppliers less than they've been squeezed during the crunch.

The sector is hardly non-competitive, either. There's a lot of firms doing what Morgan Sindall too. Economic models would predict that as competition increases, return…

.png)