N Brown (LON:BWNG) is one of the shares that has been in my portfolio since it begun nearly 20 months ago. The plus-size and niche clothing producer, home of brands like Jacamo and Simply Be, attracted me initially because of the relatively modest earnings yield on what seemed to be a solid business with a defencible position. Much of my investment methodology has changed since those early days, but that's still a position I agree with - though there's far more to it now. In this post I'll try and look at why I'm selling N Brown now, beyond the most simplistic explanation. That explanation, of course, is that the price has risen - I bought for about 250p and it's now 60% higher at 400p. Frankly, this is reason enough, but there is more to it than that!

N Brown (LON:BWNG) is one of the shares that has been in my portfolio since it begun nearly 20 months ago. The plus-size and niche clothing producer, home of brands like Jacamo and Simply Be, attracted me initially because of the relatively modest earnings yield on what seemed to be a solid business with a defencible position. Much of my investment methodology has changed since those early days, but that's still a position I agree with - though there's far more to it now. In this post I'll try and look at why I'm selling N Brown now, beyond the most simplistic explanation. That explanation, of course, is that the price has risen - I bought for about 250p and it's now 60% higher at 400p. Frankly, this is reason enough, but there is more to it than that!

The simple

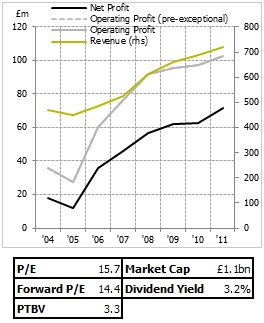

Still, the price issue deserves at least some exploration. N Brown was never ludicrously cheap - not like some of the shares that have made it into my portfolio - but I don't think midcaps do often get into that rock-bottom territory. Operating profit isn't hugely changed from '10 to now (up about 5%, below inflation), with much of the difference in net profit coming about from tax timing issues. This is good, of course - more money is always good - but it's clearly not as good as an increase in operating profit, which would signal an improvement in the underlying situation as opposed to simply jigging around what you owe Mr. Taxman. As an example, this year N Brown paid £15.9m of tax on £96.9m of tax. If no adjustments with respect to previous tax losses and carry-forwards were made, they would have paid £25.4m out.

So N Brown is in roughly the same spot it was when I bought it. In EPS terms, forecasts are flat for the next few years too. The price change, then, has basically come about because of a rerating - a difference of market opinion between 2011, when I purchased, and now. This is fine. What causes a price change is irrelevant to me; the one thing this situation does mean, though, is that N Brown is likely to have changed in my book. If the company was 60% more expensive because they were making 60%…

.png)