So Obama won the US election in what - at least from an Electoral College perspective - increasingly looks like a landslide. The vote from Florida is not yet in, but assuming Obama wins that, which looks likely, he will have 332 Electoral College votes, compared with just 206 for Romney. This is despite endless pundits telling us that the race was just too close to call and, in recent weeks, that the "momentum" was with Mitt Romney. Gallup’s daily national tracking poll put Romney ahead by five points before Hurricane Sandy, and a final national survey on November 5 gave the Republican a one-point advantage...

Who would have guessed it?

Well, actually, it turns out that there is one person that called it exactly, political blogger Nate Silver. Of the 50 States in the Election, guess how many states Nate Silver predicted the result of?

All 50! Every single one? Yep, every single one. And that's on top of him calling the correct results of 49 out of 50 States in the 2008 Election.

So who is this guy? Silver is an American statistician who runs the political blog FiveThirtyEight. After graduating from the University of Chicago in 2000, Silver worked as an economic consultant before creating a model to predict baseball player's future performance. He then sold this to stats firm Baseball Prospectus and turned to politics during the 2008 primaries.

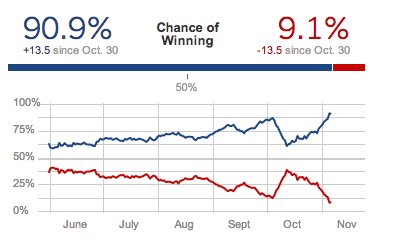

To make predictions, he uses using a model that emphasized past polling history and demographics. Unlike traditional pollsters, who put questions to a field of voters, Silver aggregates & weights other polls based on factors like the past accuracy of the polling firm, the number of likely voters and the composition of the electorate in each State. He then runs multiple simulations of the results (known as Monte Carlo analysis), which results in a probability forecast. As of Sunday night, his view was that there was a 90.9% probability of an Obama win on Tuesday, with 332 EC Votes as the most probable outcome.

And lo and behold! Quite understandably, sales of Silver's recent book, The Signal and the Noise, spiked on Wednesday to reach the No. 2 position on Amazon..

What does this mean?

This is a huge symbolic victory of what is called data science, over the traditional forecasting of experts…