** Apologies, the original version of this report corrupted, so I have reconstituted it from backup**

Good morning! Running late today, as I had to take the car in for repairs & then walk home. Plus I've generally been faffing about on emails & Twitter - two things which I think fully explain the lack of productivity growth in the UK economy in recent years!

A reminder for Mello Beckenham tonight - the new CEO of Crawshaw (LON:CRAW) will be giving a talk, which I'm sure will be very interesting. The shares have roughly ten-bagged (possibly more?!) since Crawshaw last appeared at Mello, so I'm sure the celebratory drinks will be flowing! This stock is expensive currently, but it's a potentially exciting store roll-out - therefore I can see how, in several years time, the growth may well have caught up with & overtaken the current high valuation.

Somero Enterprises Inc (LON:SOM)

Share price: 136p (down 4% today)

No. shares: 56.2m

Market Cap: £76.4m

(at the time of

writing, I have a long position in this company's shares)

AGM trading update - Somero has taken the unusual step of issuing its AGM statement a day early (the AGM is tomorrow - hopefully a friend is going, so he'll be able to let me know what management are like - I haven't met them yet).

It sounds positive,

saying that, "Strong momentum has

continued into 2015 with

solid, broad-based growth across N.America, Europe, M.East, SE Asia, and Latin

America with sales from the majority of our product lines".

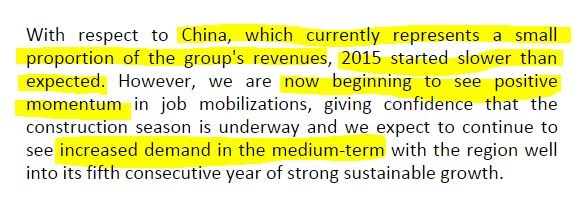

Further positive commentary is given. The only fly in the ointment is that China has been sluggish in 2015 to date;

I think it's disingenuous of the company to play down the importance of China, since they did exactly the opposite in their final results, published only six weeks ago - when emphasis was put on growth in China, and what a huge market opportunity this represented.

Furthermore, China was 16% of 2014 revenues, so if

it "currently represents a small proportion of the

group's revenues", then that suggests there's been a big drop in

sales into China.

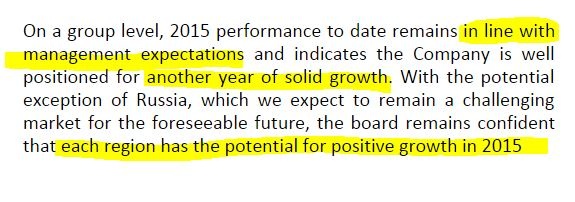

Outlook - they've clearly made up the China shortfall elsewhere, as the all-important in line with expectations statement is delivered in the final paragraph;

Hmmm, I'm confused now. They're saying that Russia is the only region expected to be challenging, with all other regions having the potential for growth in 2015. So that sounds as if they're expecting sales in China to improve later this year, which is hinted at in the earlier comments, although "medium term" suggested to me beyond this year.

Not the most clearly worded statement, it seems a bit contradictory with respect to sales & outlook in China. Never mind, the key thing is that they're in line with expectations, and the outlook sounds promising.

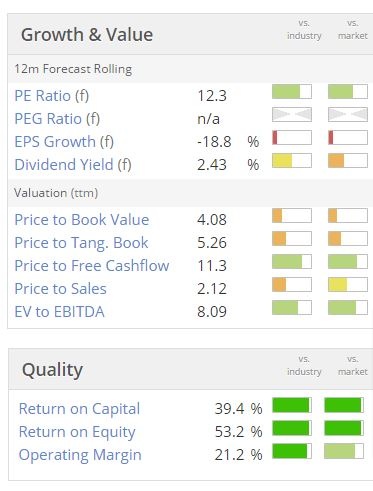

Note also that all three quality scores are excellent - this company clearly has pricing power, and seems to dominate its sector globally - the company claims 99% market share for laser-guided concrete screeding machines.

My opinion - this is one of my favourite shares at the moment. It seems a reasonably-priced growth company, is soundly financed too, with net cash, and pays divis.

Set against that, as we know, this is a highly cyclical company, making specialised, high value equipment for the construction sector, so when economies go into recession, demand drops off a cliff - as you can see from the Stockopedia graphical history;

Therefore it's definitely not the sort of share I want to be holding when Western economies slam into a major recession. The US market is key for Somero, and the comments today are positive about that. Therefore, considering the modest valuation, I think it looks a very appealing share, with the caveat that the downbeat comments about China are somewhat disappointing. I don't think that undermines the current valuation, but it perhaps chips away at the big upside that was looking possible six weeks ago.

Blinkx (LON:BLNX)

Share price: 35p (down

10% today)

No. shares: 402.3m

Market Cap: £140.8m

Final results - for the year ended 31 Mar 2015 are out, for this company, which seems to mainly operate in the USA, doing internet video search & related advertising, if that's an adequate description?

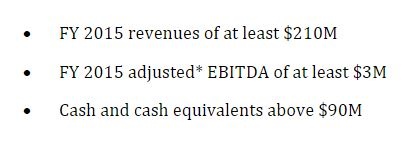

At the risk of sending ShareSoc's Roger Lawson into another apoplectic rage, I am going to comment on the results. The company has had well known problems, and it stated on 8 Apr 2015 that it was in line with (downwardly revised) expectations, telling us to expect the following key figures;

As myself & other commentators pointed out at the time, due to the way the company capitalises a lot of its costs, the EBITDA figure is meaningless. It would actually report a hefty loss overall, if it generated EBITDA of $3m.

Adjusted EBITDA has actually come in slightly ahead, at $3.5m, revenue is ahead, at $215.0m, and cash is ahead at $95.7m. So it's been nicely set up to make it appear that the company has done better than expected, but this is all nonsense really.

If you look at a proper profit figure, it's actually gone from a $17.6m profit before tax last year, to a $24.8m loss this year. So a disastrous performance, and no amount of spin in the commentary can disguise reality, despite them trying very hard.

However, the $24.8m loss does include amortisation charges of $12.4m relating to previously capitalised costs (R&D, S&M, and admin), and $4.7m in acquisition & exceptional costs. Therefore a case could be argued for focusing on the $7.8m loss which the company highlights with a box around it, on the P&L, as being a reasonable measure of performance. Bad, but not dire, might be the best description, if you are happy to focus on this particular performance measure.

Cashflow statement - this is usually of far more use than the P&L with software companies, to understand the true nature of the business's performance, in cash terms. I note from the cashflow statement that operating cashflow after tax was -$3.0m, which is hardly a disaster, although it compares extremely unfavourably with a $39.2m positive in the prior year.

The cash burn of $30.9m in the year was mainly spent on acquisitions, at $21.7m. So it looks as if the company is trying to buy in growth, given that the existing business is now struggling.

Outlook - reading the narrative, I don't think the company has really given a credible explanation for why the profitability of business model has basically collapsed. They refer to structural changes in the industry, and that Blinkx has "deliberately realigned the business to focus on Mobile, Video and Programmatic advertising channels..."

It strikes me that the original business model, whatever it was (and there are differing views on that !), doesn't work any more, so they're trying other things, and making acquisitions, using the cash pile.

This paragraph is quite revealing;

In a nutshell then, the company is currently loss-making, but hopes to be able to improve things in future.

Outlook - this sounds pretty grim to me, but they're doing their best to polish the proverbial ...

My opinion - for whatever reason, Blinkx's original profitable services are not profitable any more, so they're moving on to different, lower margin services.

So how on earth can the company be valued? It's loss-making now, therefore we can't use a PER, and forward estimates of profit are surely little more than guesses at this stage?

On the other hand, it has a strong balance sheet, with net cash of $95.7m, about £61.0m. Although cash is reducing quite rapidly, partly from trading losses & capex, but mainly from acquisitions.

Overall I just think it's impossible to value. If you think they can pull something out of the hat, and become profitable again, then that's the only reason I can see for wanting to hold shares in a loss-making group which has a bit of a whiff about it. It doesn't interest me, as I can't see where the profits are going to come from, and today's statement doesn't give a lot of clues either.

Panmure Gordon & Co (LON:PMR)

Share price: 129.5p

No. shares: 15.5m

Market Cap: £20.1m

(at the time of writing, I hold a long position in this share)

AGM Statement - this sounds generally upbeat, but is light on specifics. Key points;

- "Robust performance" in 2014

- Dividend payments are to re-start after 7 years' absence

- Stockbroking commission rates remain under pressure

- Corporate finance activity key to profitability

- Healthy pipeline of transactions

- Acquisition of Charles Stanley Securities should be completed by end May 2015

My opinion - this sounds alright to me. It will be good to start receiving divis.

Plus500 (LON:PLUS)

Share price: 524p at 15:18 (down 30% today)

No. shares: 114.9m

Market Cap: £602.1m

Breaking news - FT Alphaville have run a story today saying that Plus500 has suspended some UK accounts pending customer verification measures related to money laundering regulations.

Customer accounts are being frozen, with them unable to with draw funds, until proof of ID & address documentation is supplied.

My opinion - I've never liked this share - the figures looked too good to be true, or at least too good to be sustainable. It looks as if the company might have been playing fast & loose with the regulations. If you're an optimist, then you might see this as a buying opportunity, as business may return to normal once customers have sent in the required documentation.

On the other hand, if this closes the door to easy acquisition of mug punters, to lose money on their trading platform, then it could mean a permanent & serious drop in profits. Who knows?

No doubt the company will imminently issue a reassuring statement saying that everything is fine, and it will be business as usual very soon, and that might trigger a bounce in the shares.

Personally I try to avoid all overseas companies listed on AIM, as there's usually something wrong with them. I also avoid catching a falling knife where there is some serious problem with the business model, which I think there might be here.

Who knows what will happen next, but personally it looks to me like the company is in chaos, and hence it's not a share I would want to be holding.

Company announcement - this has just been issued. Key points;

- Confirms that final & special divis have been paid, contrary to rumours

- PLUS has $88m in cash reserves (in addition to client funds)

- Clients affected by new documentation checks - 50% (UK) * 55% affected = 27.5% of all customers

Will be interesting to see how this pans out! I'm wondering whether having to provide proper ID when opening accounts might reduce business somewhat, but is it going to destroy the business completely? I very much doubt it.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.