Norcros (LON:NXR): a maker of bathroom fittings and appliances, including Triton showers, Croydex bathroom furniture and taps. Glamorous stuff!

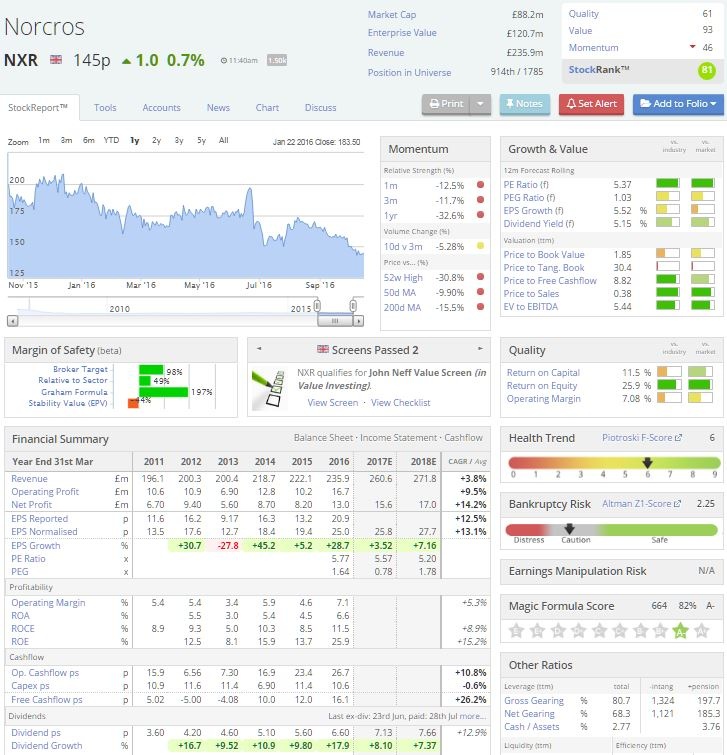

Market cap. now only £88m, with the share price sliding from a 208p peak in December 2015 to just 145p today. Clearly Norcros has suffered sentiment-wise from its gearing to the housing and home improvements market.

But there seems to be a lot of value in this stock today, at least judging from the Stockopedia data (93 Value rank):

Valuation: With a forecast P/E rating of 5,4x almost in line with a 5.2% forward dividend yield, this is a stock that pretty much satisfies Lord Lee's rule of thumb of companies with a dividend yield equal to or above the PE.

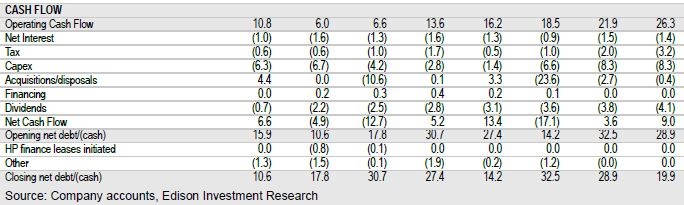

Cash flow: Digging into the free cash flow generation of Norcros, I was pleasantly surprised. Yes the company has net debt, resulting from making a number of acquisitions which have obviously added to the top-line. But looking forward, free cash flow generation pre-acquisition spending and pre-dividends looks like it could be around £10m per year, i.e. a free cash flow yield of over 11%.

So not only does the dividend look pretty secure barring disaster, but the debt should be paid down fairly quickly too.

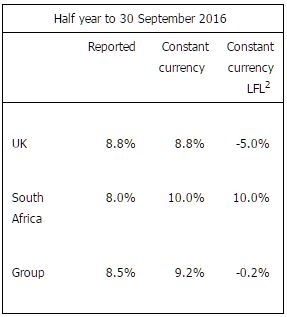

Growth: this is coming largely from the UK acquisitions Croydex and Abode (+14%), with like-for-like sales growth sharply mixed between the UK (-5%) and the South African (+10%) businesses.

Source: Norcros, 11 October 2016

The 11 October trading update looks solid:

"Group underlying operating profit in the first half is expected to be

in line with the Board's expectations."

Profitability: a Return On Equity of 26% looks set to be maintained going forwards, while an EBITDA/total assets ratio of over 30% is good (they don't give a gross profit figure).

Net debt has already fallen £4.5m to £28m now from the Mar-17 year end level of £32.5m, highlighting the company's commitment to paying down debt.

FX: There was a small FX headwind (average £/ZAR c 19.7 vs 19.3 in H116) in H1 '17, but with the current £/ZAR exchange rate at ZAR17.3, this swings back into the company's favour heavily given the recent depreciation of sterling.

Summary: All in…