Small companies are often not lacking in ambition and this is certainly the case for building products company Norcros. The group is looking to lift sales to £420m by 2018 from the £222m seen in the year to March 2015. Recent trading has been mixed and so the key will be to successfully complete and integrate acquisitions.

Norcros listed on the London Stock Exchange at 78p in July 2007 and had a market value of £116m. Less than two years later the shares had fallen to 4p as the economic slowdown hit demand.

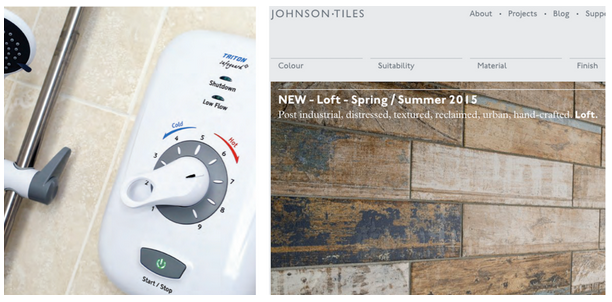

Norcros boasted when it made its IPO that Triton showers had the leading position in the UK domestic shower market and Johnston Tiles is the UK’s top tile maker. The group’s South African business also offered exposure to a long-term growth market.

Triton Showers & Johnston Tiles

Source: Norcros website

Clearly the IPO story was overhyped with the downturn hitting demand for construction related products. In July 2009 the group announced an open offer at 7p a share, in order to reduce debt, with the shares issued 74.2% of the enlarged share capital.

This is hardly the most impressive backdrop for a listed company but Norcros now appears to be on the mend. Revenue in the year to March 2015 rose by 1.5% on a reported basis and 5% on a constant currency basis.

Norcros also bought Vado - a maker of taps, showers and accessories – in April 2013 for an initial payment of £11.9m and further payments of up to £4.1m. In June 2015 the group announced the purchase of Croydex for £21.9m.

Croydex appears to have a similar business to Vado in that it makes “high quality bathroom furnishing and accessories.” Both takeovers have been funded using existing resources and debt and as such will lift earnings.

Against this mixed backdrop the shares trade on a forecast of 9.5X earnings for the year to March 2016 which falls to 8.5X in the following year. The focus on revenue growth and acquisitions offers potential upside but also increases the company’s risk profile.

Norcros today

Norcros is a £125m market value company which generates two-thirds of its revenue from the UK and a third from South Africa. The largest division is Johnson Tiles UK and the second largest revenue generator is Triton showers.

The…