Paragon Group is a UK consumer finance business where the main focus is providing buy-to-let mortgages. The two other divisions are Idem Capital, which buys consumer debt, and the recently launched Paragon Bank. During the global financial crisis Paragon suffered from a liquidity crisis but the underlying asset portfolio was resilient.

Residential buy-to-let investments are popular in the UK and are likely to remain so with the introduction of new pension freedoms in April 2015. These allow pension savers to withdraw their assets when they had previously been forced to buy annuities.

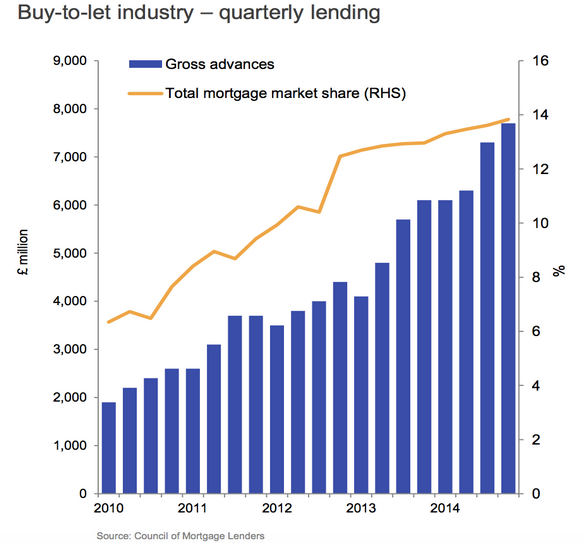

Even before this change the buy-to-let mortgage market in the UK has been seeing a rapid recovery. This is perhaps not surprising given the strong performance of residential property and the imbalance of supply and demand for housing.

Source: Paragon Group investor presentation

In the 18 years from 1996 – the year UK buy-to-let mortgages were introduced – an initial £1,000 invested in buy-to-let would have risen to £13,000. This reflects the assumed loan to value ratio of 75% and the performance of residential property values.

In the same period a cash buyer of property would have seen their initial investment rise to £4,791 and equities would be worth £3,082. The appeal of buy-to-let residential investment is clear although future house price gains are set to be more modest.

Paragon Group provides buy-to-let mortgages and is currently benefiting from the rapid growth in demand. The company is the only specialist lender to have an independent position in the UK mortgage market.

People who make buy-to-let investments will typically own their own homes and have good incomes. With residential property also resilient this means that the asset quality of buy-to-let loans in the UK should be robust.

Looking at the valuation and Paragon trades on 12.7X forecast earnings for the year to September 2015 which falls to 11X in the following year. The forecast P/E drops to 9.7X in the year to September 2017 which doesn’t appear to expensive.

Paragon during the financial crisis

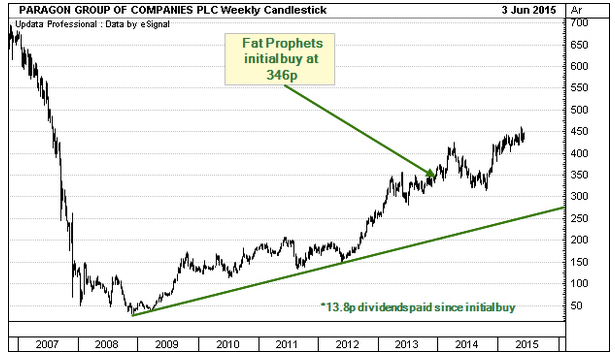

A look at Paragon’s share price chart from 2007 to 2008, though, shows that things haven’t exactly been a bed of roses for investors. This reflects investor scepticism of Paragon’s business model and its ability to access short-term finance.

The concerns were proved correct in 2008 when Paragon’s UK lenders declined to…