Pittards (LON:PTD) is a 'premium leather and leather products' brand, based partially in the UK and partially in Ethiopia. They seem to make a pretty broad range of products, with 'technically advanced' leathers being a common phrase in their annual report. That said, first thoughts are that it sounds like a commodity business; as the board quite reasonably puts it:

Pittards (LON:PTD) is a 'premium leather and leather products' brand, based partially in the UK and partially in Ethiopia. They seem to make a pretty broad range of products, with 'technically advanced' leathers being a common phrase in their annual report. That said, first thoughts are that it sounds like a commodity business; as the board quite reasonably puts it:

"The leather industry is a global business: wherever countries have meat and dairy industries then hides and skins are produced as by-products."

And while I'm not an expert on the industry, or any industry for that matter, I would imagine the economics of having relatively dispersed raw materials would lend itself to having a relatively dispersed market structure. Pittards is by no means a particularly big company, which might lend weight to this theory. The attraction isn't as immediately evident as it sometimes is, then; we don't have an obviously defensible market position, a leading company in a niche or similar.

The eternal temper

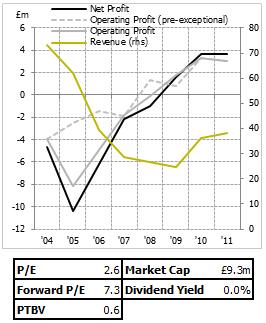

The attractive factor is the usual - the price. It's trading at a decent discount to the assets in the business, and it's profitable, too. Those two factors aren't always particularly easy to find together. At this point it's probably wise to note the bid/ask spread, though, since in this case it is particularly relevant to any discussion of the 'price' - iii quote the bid at 1.75p and the ask at 2.25p. This is an enormous difference. I usually use the midprice in my calculations, out of habit more than anything, but it should be noted that spreads this wide can be a significant dampener on returns.

Anyway, as always, I've stated the hypothesis - that Pittards is cheap because it is trading at less than the value of its assets as a profitable business, something which loosely shouldn't really happen if flows of capital are free and transactional costs are minimal (though we've already disputed that). More importantly to us and much more solidly, low PTBV values and low P/E figures, though imperfect, are also correlated with higher future returns. There. Easy!

The wrecking ball

It's never that easy, of course, and the first question we have to ask is immediately obvious from the graph in the top right - what happened? Pittards was shoveling money out of the…

.png)