As I mentioned last post, while looking over my portfolio I thought it'd probably be prudent - at long last - to take another look at Creston (LON:CRE) and Plastics Capital (LON:PLA) . Both are companies which have been with me since 2011, and their fate is something of a sorry one. They originally had weights of about 5-6% in a portfolio with more stocks than I now particularly like holding, and since the rest of portfolio happily appreciated while both CRE and PLA hovered around the same, they now occupy about 3% each in a portfolio with only 11 shares. They haven't done that badly, to be fair - PLA is up 15% pre-dividends and CRE about 20%, but that's hardly an exciting return for a small cap share over the last couple of years. The last paragraph of my last post most or less sums up my thoughts:

I'm not averse to having such small holdings, but given their size I haven't taken the care I should do with considering them. I'm very much of the opinion that too much diversification simply dampens returns, so I want to either reaffirm that I like the shares - and therefore buy more - or decide that holding them simply because they haven't done much and I haven't given them much thought is a fool's errand, and therefore sell. Expect a post on that soon!

So, without further ado, a short section on each of the offenders, and what I'm planning to do with them.

Plastics Capital

Plastics Capital is a 'consolidator' - they acquire different companies, cut out centralised costs and generally enjoy some of the advantages of scale. They're not huge, mind you, but they are certainly a collection of companies which benefit from being under the same banner. The sort of companies they acquire are achingly niche, too - a producer of 'crease matrices', for instance, which are components used in the production of cardboard boxes and packaging.

Plastics Capital is a 'consolidator' - they acquire different companies, cut out centralised costs and generally enjoy some of the advantages of scale. They're not huge, mind you, but they are certainly a collection of companies which benefit from being under the same banner. The sort of companies they acquire are achingly niche, too - a producer of 'crease matrices', for instance, which are components used in the production of cardboard boxes and packaging.

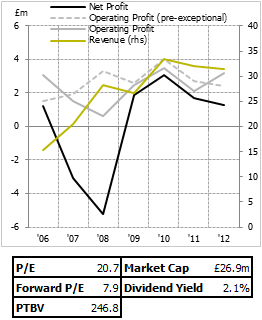

I like the business strategy, and given the niche nature of it it's perhaps not that surprising that the company has consistently earnt a strong return on capital - above 20%, for the most part. Its figures as reported under-represent the strength of the business, since…

.png)