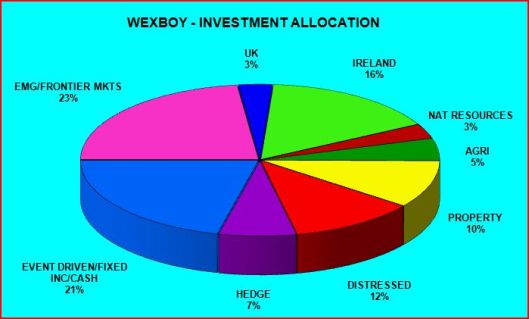

Continued from here. Wow, it’s been a leisurely journey – spanning a full year – is this really my last post of the series?! Hmmm, we’ll see… Here’s my portfolio allocation pie chart one more time:

[NB: This is from Jun-2012, but since then the only major changes (funded mostly from my Hedge Fund allocation) are: a) an increase in Property from 10% to 13%, as I continue to scale up my German property exposure (see Parts I to V - also here), and b) a large jump in Agri from 5% to 11%, due to my purchase of Donegal Creameries (DCP:ID) & its subsequent hefty appreciation. Note I don't classify DCP as an Irish stock - after all, the company feeds people (potatoes, mushrooms & yogurt) and animals, what could offer a more ideal uncorrelated exposure?!]

First, I think one last portfolio overview will provide some valuable context for my final allocation: Once again, it’s worth observing this probably doesn’t look anything like a normal portfolio to many investors! But I can assure you it’s quite intentional, and also pretty representative of my long-term strategy. On average, I’m striving for (say) a 50:50 split between Equities (Emerging & Frontier Markets, UK & Ireland – 42%) on the one hand, and Real Assets, Distressed & Alternative Investments (inc. Cash & Fixed Income) on the other. It’s worth noting my total non-Equity allocation isn’t (necessarily) designed to be low volatility/return. Actually, I’m v happy to accept higher volatility in exchange for higher long-term returns. But it is designed to offer significant diversification, and to ensure a substantial portion of my portfolio enjoys (ideally) a low, neutral, or even negativecorrelationwith the market & the economy.

[Admittedly, this lack of correlation is somewhat of a pipe-dream...at least in the short-run. To explain: My non-Equity investment theme(s)/allocation is mostly created via listed equity investments - and when markets crash, we unfortunately re-discover pretty much all equities crash, regardless of their underlying fundamentals or lack of correlation. However, I'm confident the benefits of this allocation approach can be realized in the long-run].

My allocation is somewhat skewed right now against Equities. Mostly because I’m happy to ignore benchmarks & omit vast swathes of the (developed) world from my portfolio…like Japan & the US!…