From the wilderness of the last three companies I've looked at, I've jumped back into something I'm more familiar with. No more structural steel or horse-racing bookie services, here's one even I can understand at first glance - Prezzo (LON:PRZ) , the restaurant chain. If you live around the south of England, you've probably got a few near you and you might've even been to one. They do the sort of casual Italian-esque fare that's been rather a driving force of the restaurant industry (at least from my casual observation!) recently, and look like a genuine recent start-up to success story. They were admitted to the AIM in 2002, raising a rather humble £1.5m and valuing the business at £3.7m.

From the wilderness of the last three companies I've looked at, I've jumped back into something I'm more familiar with. No more structural steel or horse-racing bookie services, here's one even I can understand at first glance - Prezzo (LON:PRZ) , the restaurant chain. If you live around the south of England, you've probably got a few near you and you might've even been to one. They do the sort of casual Italian-esque fare that's been rather a driving force of the restaurant industry (at least from my casual observation!) recently, and look like a genuine recent start-up to success story. They were admitted to the AIM in 2002, raising a rather humble £1.5m and valuing the business at £3.7m.

The history of its formation is interesting, too; one of the things that first catches your eye on the admission document is that the joint managing director (now CEO) was 22 when he co-founded the company. A little further digging - or a touch of knowledge on the Kaye family name if you're more worldy than I, I suspect - would dig up that the myriad connections. Golden Egg, Garfunkel's, Ask, Zizzi; all restaurant chains related to the family.

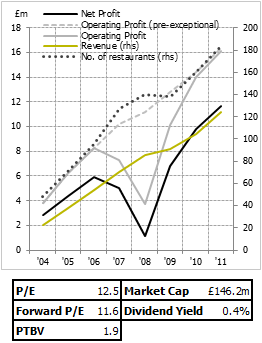

Back on Prezzo, though - their growth story is pretty obvious if you take a look at the graph to the right, where I've added a new line showing the number of restaurants they've opened. I suppose it shows a decent choice of premises, given how tightly operating profit and the number of restaurants are linked. Indeed, operating profit hovers between £80k and £90k per restaurant, though revenue does seem to be on an upward trend. Putting those two together leads to the obvious conclusion that margins are tightening. That is indeed the case; though perhaps there is a nod towards the direction of saying that we can expect restaurant margins to be squeezed in a recession. I'm not hugely swayed by that train of thought, but I suppose it could be worth the few percentage points that are in this.

There's no sign of a let up, either, with the last half-yearly anticipating another 25 restaurants this year (27 last). Full steam ahead; and it makes sense, given that it's working so far, and benefits usually come with scale. That seems particularly the case in the restaurant…

.png)