Andrew Oxlade, the Telegraph's Money Journalist of the Year, wrote a terrific feature at the weekend about the growing rise of the idea of investing in 'quality' stocks. While the concept of what makes a 'quality' stock is perhaps harder to define than what makes a cheap or growing stock, Oxlade cuts through the jargon by zeroing on on the concept of Quality Income and listing the ten stocks currently qualifying on Stockopedia's popular screen of the same name.

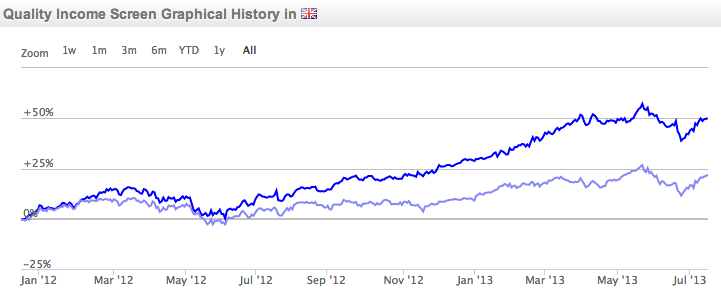

The performance of the Quality Income screen has been nothing short of remarkable since we launched it over 18 months ago - with a total return of over 57% to date. Considering this is a strategy that only invests in larger UK companies it is no surprise that it has turned heads.

But as Oxlade points out, the strategy is showing less and less candidates. 18 months ago there were 18-20 stocks qualifying compared to the 10-12 today. These exacting criteria, which search for large caps boasting a yield greater than 4% as well as strong fundamentals, are harder and harder to meet in an environment that has dramatically favoured dividend paying stocks over and beyond all others.

In fact, there are many who think that dividend paying stocks have travelled too far, too fast as yield starved investors chase anything paying a decent return. Indeed over the last three months, the strategy has begun to underperform. The question for investors who wish to play the Quality theme is where to now?

Accidental Income using Quality + Value

One answer could be to stop focusing solely on yield. Value investors have long understood that the dividend yield is just one of many value ratios, and that indeed it isn't even the best performing. Over the long term, High yield portfolios tend to underperform those constructed using low P/E ratios and especially those that use a blended value approach.

Richard Beddard, one of the UK's finest financial writers writing for Money Observer and Interactive Investor, has long explained that investors should be wary of constructing their portfolio solely for yield. It makes more sense, he says, to construct a portfolio based on the economics of the underlying companies treating the dividends received as rather an accidental bonus. Indeed by constructing portfolios in this way, Beddard discovers 'accidental' yields greater…