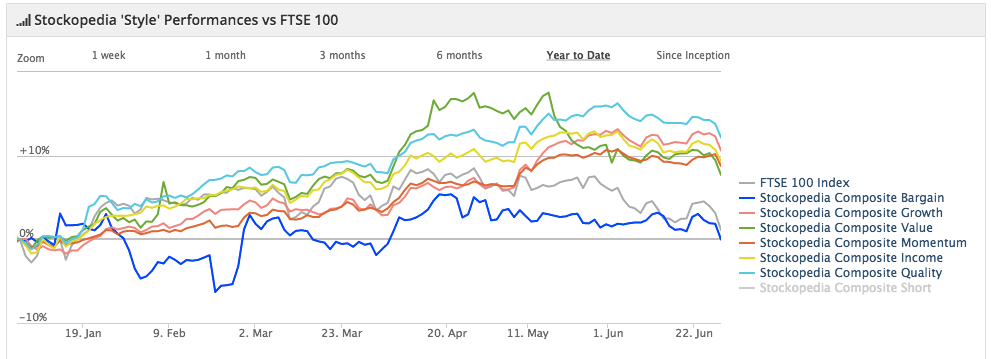

UK share indices have been in good shape through much of 2015. But in the final days of the first-half, the Greek debt crisis served to shake confidence and take the sheen off that performance. For the 60 guru-inspired investment strategies tracked by Stockopedia, the generally upbeat conditions have been a welcome change from a tough time in 2014. In the first quarter, Quality and Value were the the styles that performed best on average. But as we moved into Q2, it was Growth and Momentum strategies that took the lead.

Overall, the Stockopedia Composite Long index - which aggregates the performance of all the guru strategies - rose by 3.2% during the second quarter. In the year to date it is up by 8.2%.

In Europe, the Stockopedia Composite managed a 6.8% return in the first-half against a resurgent FTSEurofirst 300, which rose by 10.8%. In the United States, where the S&P 500 has drifted sideways for most of 2015, the Stockopedia Composite lost some strong Q1 gains to end the half more or less level pegging with the index, up 0.2%.

High StockRank shares pay off

Elsewhere, there was another strong performance by stocks with high StockRanks - Stockopedia’s system for scoring and ranking every company in the market according to its Quality, Value and Momentum characteristics. In Q2, a tracked portfolio of stocks with a market cap of at least £10 million and StockRanks in the top 10% of the market rose by 11.8 percentage points. Since tracking began in April 2013, that quarterly rebalance basket has returned 64.0%

| Index / Strategy Composite | % Change Q2 2015 | Year to Date 2015 |

| FTSE 100 | -3.7% | -0.7% |

| FTSE 250 | 2.6% | 9.0% |

| FTSE All Share | -2.5% | 1.0% |

| FTSE SmallCap XIT | 4.4% | 10.2% |

| AIM All Share | 5.5% | 7.6% |

| Guru Strategy Composite | 3.2% | 8.2% |

| Income Composite | 2.6% | 8.7% |