Growth and momentum strategies proved to be the big winners among Stockopedia’s GuruModel Screens during the second quarter of 2013, with the majority outpacing the FTSE 100 in a period that delivered a long anticipated correction in equity prices. With our quarterly rebalancing due this weekend, we’ve reviewed what worked and what didn’t during the rollercoaster that was Q2.

After a slow start to the quarter, the FTSE saw a sharp rise of 8.9% between 22 April and 22 May, taking it to a high of 6,840 points. A retrenchment saw those gains wiped out by mid-June and the blue chip index is now trading up by around 6.9% for the year to date, down from the 8.7% gain at the close of the first quarter. By comparison, the FTSE AIM 100 is currently trading down just 3.4% at 3,260 from where it was on 22 May. While it has recorded a more modest 2.9% gain so far in 2013, the latest movements suggest that the leading small cap shares in the market have so far weathered this correction better than their larger peers.

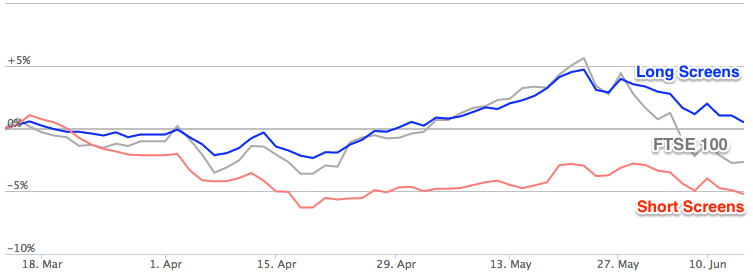

Of all the long only GuruModel screens that we track at Stockopedia, an impressive 68% outperformed the FTSE during the rolling three month period since our last rebalancing on 15 March. On average, long screens produced an unexciting return of 0.5% while short screens fell by 5.2% versus the FTSE which fell by 2.7%. You can see the three-month performance table here.

How things changed in Q2

Given the choppy market conditions it was unsurprising to see some changes among the top performing GuruModels between the two quarters. The volatile Benjamin Graham-inspired ‘Net Nets’ bargain investing strategy took top honours in Q1 but its performance deteriorated during the spring, underperforming the FTSE by 3.2% (although still delivering a 14.2% gain so far this year). Graham’s conservative valuation model, which looks for shares trading at much less than liquidation value, turned up a number of decent turnarounds earlier in the year. But the portfolio of predominantly micro-cap stocks took some heavy losses during the second quarter, with the notable exception of engineering minnow Pursuit Dynamics (LON:PDX) (up over 120%), which spared what could have been a bloodbath on this screen.