This is following on from a previous update I did on a paper portfolio I’ve been running since August last year. I’ve just put it through a second rebalancing and thought I’d share the results again. It is actually almost 3 weeks late to be honest but things have been busy at work and I’ve just not got round to doing it until now.

A quick recap…

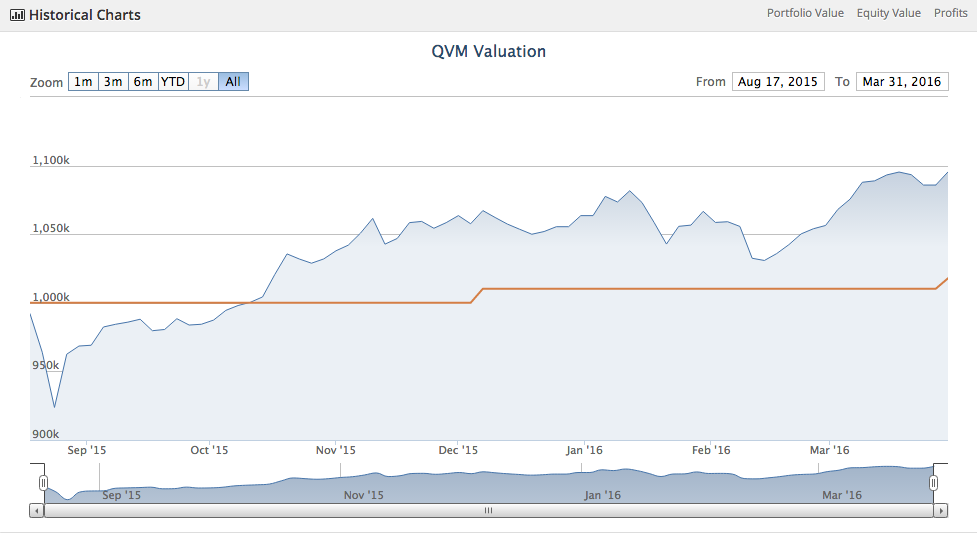

Last time things got off to a pretty hairy start as I started the portfolio shortly before a market downturn in late August. Despite early losses, the whole thing came back later in the year to end about 5% up including the effects of dividends and transaction costs (commission plus SDRT where appropriate). Not bad for a period where the market was down about the same.

I concluded though that some changes should be made to the approach which, admittedly, had been thrown together fairly haphazardly. The changes were as follows:

- I decided to exclude Oil & Gas and Mining shares until things looked a little more positive in that space.

- I chose to remove the additional F-Score criteria for fear of double counting (though I am still sorting by F-score when picking my 30 stocks).

- I added in requirements of PB > 0 and PE > 6 to try and filter out companies with negative equity and ‘too good to be true’ valuation ratios. Not perfect by any means, but possibly better than nothing.

How did we do this time around?

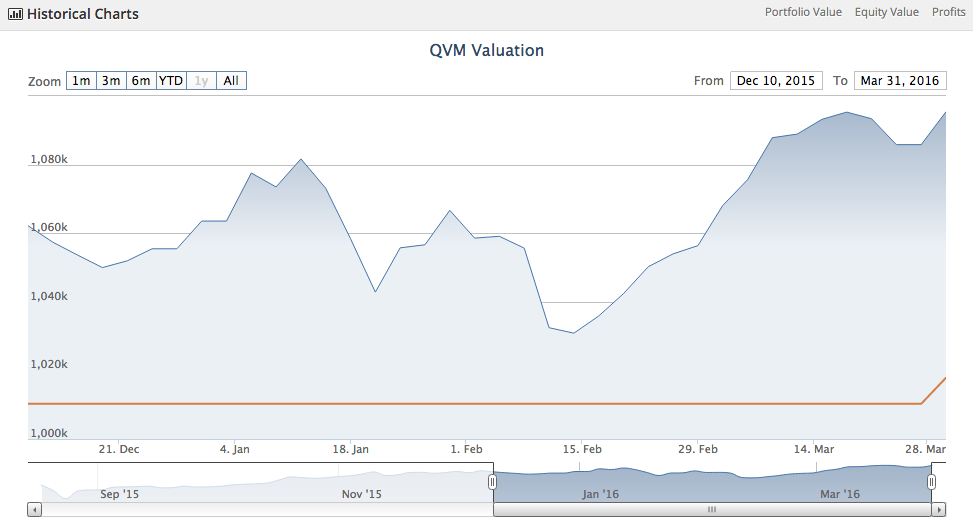

Well, poor timing seems to be a theme on this one as shortly after rebalancing the market took yet another turn for the worse… For a couple of months the whole thing was highly volatile and I ended up giving up around half my gains by early February.

Thankfully, comebacks are second recurring theme here and the portfolio rebounded strongly with the overall market and ended at around a 9.5% gain since inception by the 30th of March. This includes the effects of dividends and, as always, transaction costs.

Here’s a look at the performance to date after selling all the holdings from this quarter:

And a look at the performance this quarter:

Note that the upticks in cash are me being lazy with dividends. I can’t be bothered to look up individual dividends and put them in so I just deposit cash equal to the portfolio yield divided by…