Property developer Quintain Estates is developing residential apartment blocks next to Wembley stadium. With demand for London housing outstripping supply the group is well placed. It not surprising, then, that Quintain has received a takeover offer but the valuation appears low.

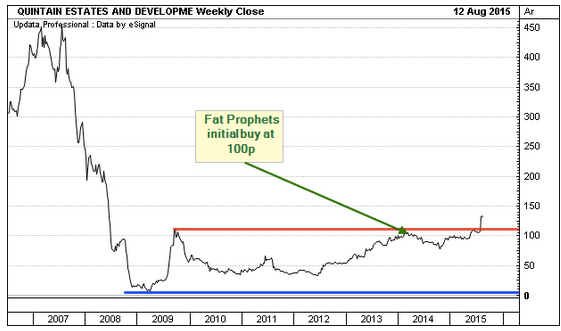

Takeovers are the closet the city comes to war with two sides fighting it out. In the case of Quintain Estates there hasn’t been much of a fight yet with the company’s directors recommending a 131p cash offer.

Quintain is developing Wembley Park

Source: Quintain Estates

This leaves it up to Quintain Estates’ shareholders as to whether they accept the valuation arguments from the company. In our view, it is likely that Quintain’s shareholders will hold out for a higher price.

If the offer falls through then Quintain’s share price could fall back to the pre-bid level of 107p. However, the potential acquirer, Lone Star, looks set to be a determined bidder.

In the recent case of Dragon Oil the initial offer from ENOC was set at 735p a share. This was later increased to 750p a share and then finally 800p to clinch the deal with Dragon Oil’s shareholders.

Quintain Estates profile

Property development is a sector that booms in the good times and comes close to bankruptcy in downturns. This is because developers have projects that aren’t generating an income and use debt financing.

When the music stops these two attributes leave real estate developers with nowhere to hide. Quintain Estates certainly faced the music in the financial crisis with its share price falling from 450p in 2007 to 4p in 2009.

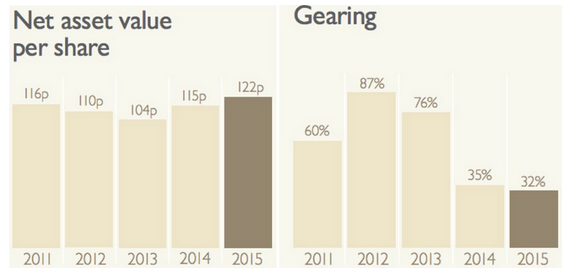

Quintain has recently been reducing its gearing level with it at 32% in March 2015 versus 87% in March 2012. The net asset value (NAV) per share has increased in the last two years and hit 122p at March 2015.

Quintain de-risks and returns to NAV growth

Source: Quintain Estates

Quintain is now focused on Wembley Park in London with this area 77% of its asset exposure at March 2015. Wembley investment assets are 33% of total assets and development land is 42% of total assets.

Land in development at Wembley is 5% of assets and outside of Wembley the London investment portfolio is 11% of assets. As such Quintain is a bet on the London property market and in particular Wembley Park.

Quintain Estates asset…