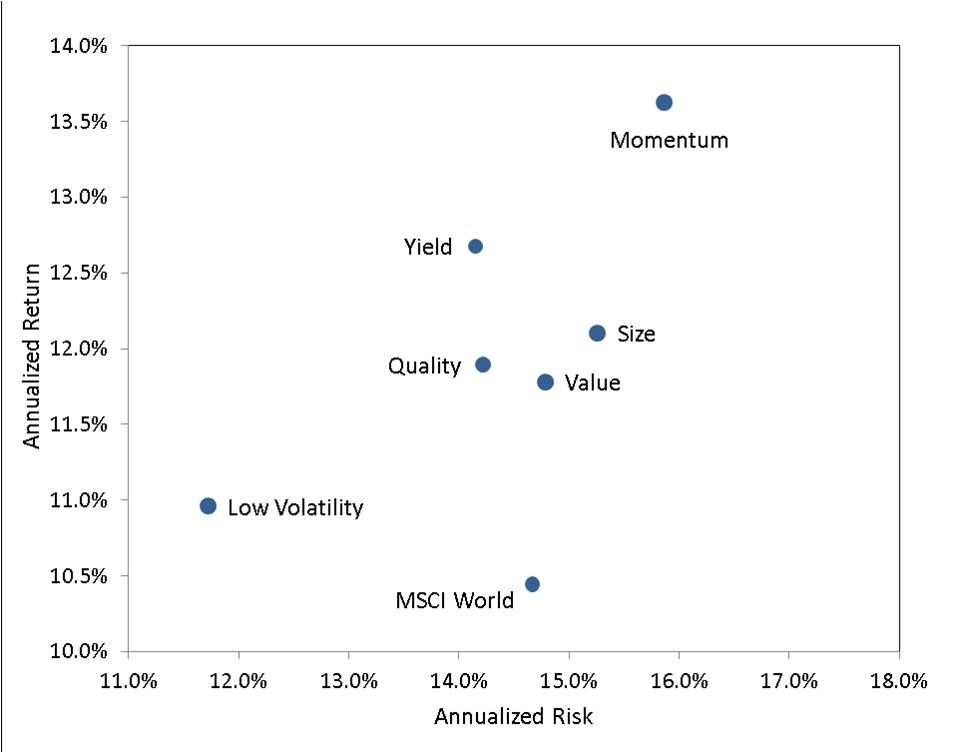

Whilst Googling Stockrank style "Factor" investing I came across a June 2015 paper published by MSCI called, THE MSCI DIVERSIFIED MULTI-FACTOR INDEXES - Maximizing Factor Exposure While Controlling Volatility. The diagram below shows the net return of different Momentum etc Factors back tested over the last 40 years.

The risk/return characteristics of MSCI "Factors" 1975-2014

It seems MSCI offer various ETFs based on their Multi-Factor Index. MSCI factors are not the using the same QVM algorithms as Stockranks and the markets and re-balancing periods are very different. Nevertheless the MSCI factors are showing a useful return premium for each of the factors investigated, all of which have beaten the market over an extended period.

The principle MCSI Factor calculations are based on:

Value: P/B + PE + EV/CFO (except Financials)

Momentum: historic alpha, 6m return, 12m return

Quality: ROE + Debt/Equity + Low 5y Earnings Variability

Low Size: log of market cap

So it's clear that some ETFs have jumped on the Factor scoring bandwagon. We don't have access to the MCSI database, but we do have the Stockrank QVM Factor scores (and combinations thereof), which I believe are a brilliant extra addition to the private investors armory. In addition the Stockrank score is designed to be partially forward looking so we may have an algorithm edge that some other Factor scoring methods do not.

I do wonder if combining the high scoring Stockrank QVM Factor approach with additional weighting for additional "market anomalies", such as a significant recent Earning Surprise and/or Earnings Upgrade would further enhance returns? The same comment could apply to recent significant QVM upgrades ,or (as in my particular case) an additional Quality (>80) screening aspect?

For those interested in Factor type methodology the MSCI paper is available as a PDF download - but you may have to register as a company. Ian https://www.msci.com/documents/10199/a49f25c5-982e...