Hi All,

A chunk fell off Regus (LON:RGU) today following their interim results, nearly 10% in fact, so worth a bit more of a delve into the announcement to see why this may be.

Before I enter into these fits of barely-there investigative accountancy, I always remind myself that it pretty much always boils down to the fact that marked changes in the price are as a result of expectations being missed or exceeded. But who's expectations, and is it such a problem so long as my assessment of the situation remains valid? I suppose not, but I often find it hard to ignore the avalanche of opposing opinion that a reduction like this amounts to.

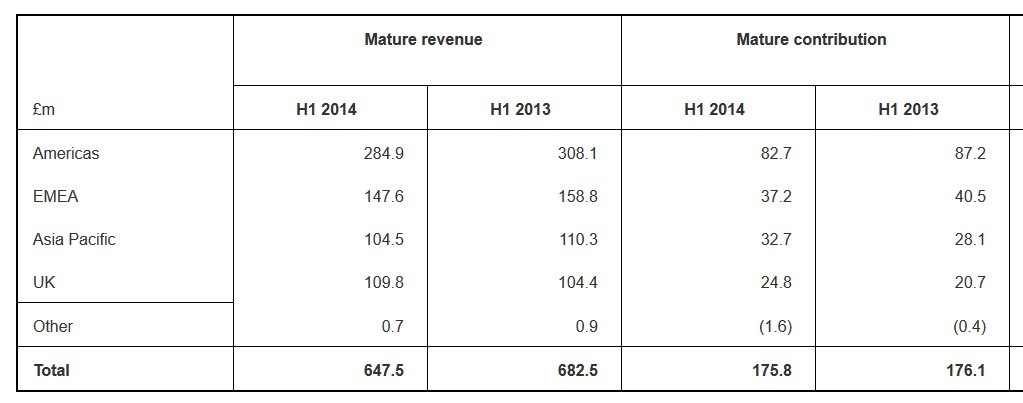

In Regus (LON:RGU) 's case I imagine the bulk of the sell off can be linked to the 7% reduction in EPS from last year, a disappointing result on the face of it. The results obviously don't highlight this drop in EPS, but instead litter the announcement with 'Constant Currency' metrics, which are more flattering. As a general rule I'm always a little wary of announcements that labour heavily on the impact of currency headwinds, as they can often be used as scapegoat to mask poor underlying performance. However, in Regus's case I think it may be valid for them to do so. The regional review in the notes shows that 83% of their revenue and 87% of their profits are non-UK derived, so naturally a strong pound will create a significant negative effect on reported results for Regus. Using Constant Currency metrics the EPS figure is actually improved 24%, up to a reported EPS increase of 17%. This pattern is reflected throughout their results, where Constant Currency metrics are markedly ahead of the GBP figures. This doesn't change the half yearly results, but for me indicates that the underlying business is performing well and the international nature of their business is playing against them when it comes to reporting.

One thing to note with Regus is that they are not an export based business and the majority of their CAPEX and operating costs will occur in the same countries from where their revenue derives. This means that they won't have to exchange revenue at unfavorable rates, so their use of Constant Currency metrics is a fairer reflection on…