As part of our research when assessing prospective share purchases it is important to look at trends in certain key figures and ratios across a number of years. In particular, dividend investors are usually keen to see a history of increasing dividends per share over several years as this gives some confidence not only that the company has been performing well, but also that dividends are viewed by the directors as an important part of their shareholders’ return.

Although the continuing payment of dividends is not a legal obligation – in fact it is totally at the discretion of the directors – it is often considered to be a “moral” commitment by the company to at least maintain, and preferably grow the annual payout. To cut the dividend is not only frowned upon by shareholders, but it is an admission of poor performance by the company or concern about its near term prospects or financial health. It is also often thought that such a moral commitment grows deeper within the company’s culture the longer the period over which the company has continued to grow or maintain its dividend, as well as being prima facie evidence that a company can weather different macro environments and business cycles.

So we might often hear reference to so-called “dividend heroes” which have continuously maintained or raised their dividend payouts over many years. For us to establish dividend growth and earnings growth histories we need to look at the company’s archive of annual reports, although when we do so we need to exercise great care over any historical per share figures. When there have been changes to the issued share capital of a company which had no impact upon its financial resources, then certain adjustments to such historical figures may be required. Very often investors will misquote the financial history of a company if they fail to pick up on such adjustments and therefore this is an important point to bear in mind when carrying out research.

The changes in share capital to look out for are as follows:

- Share splits

- Share consolidations

- Bonus issues

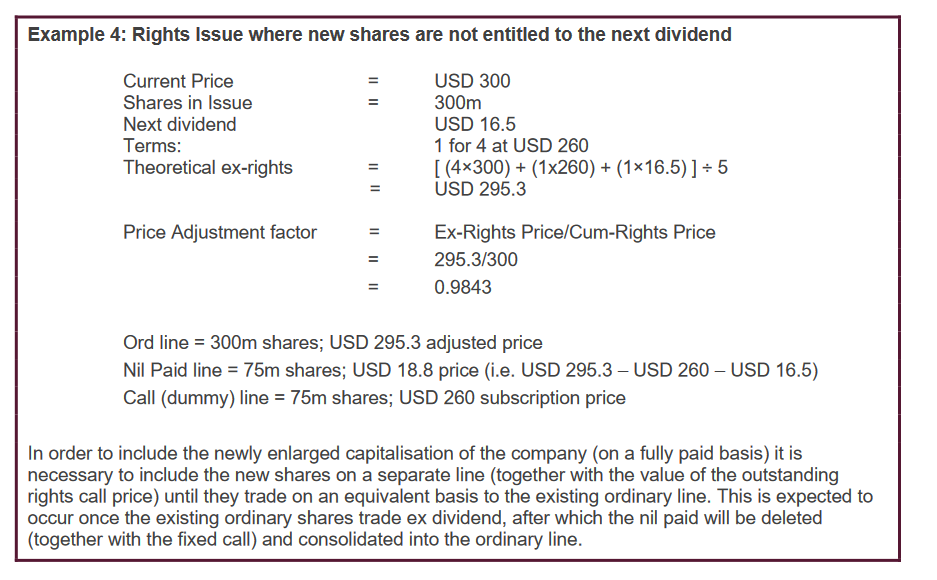

- Bonus element of other issues such as rights issues

Share splits

Occasionally, after a company has enjoyed many years of profit growth and its shares rise very strongly, each of its shares could become worth tens, hundreds or even thousands of pounds. As a result the company may decide that it wants to improve liquidity…