Beer and soft drink manufacturer SABMiller PLC has had a fantastic run over the past few years. The shares have leapt from less than 1,000p in the financial crisis to around 3,250p today.

But does that mean the best gains are in the past rather than the future?

In order to find out (or at least develop a sensible opinion), I’ll run the company and its shares through a checklist of 24 questions ending with a calculation of a “fair value” and “good value” share price.

Overview

SABMiller is one of the world’s largest beverage companies and has been brewing beer for over a century. Its global beer brands include Miller and Grolsch and it is also one of the world’s largest bottlers of Coca-Cola products.

It operates in the defensive Beverages sector and has a significant footprint in emerging markets, making it a favourite of many relatively defensive investment funds.

Investment checklist

1. Does the company have an above average track record of growth?

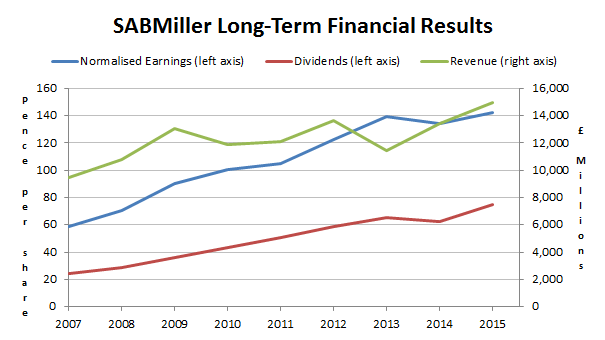

YES – The chart below shows how SABMiller’s financial results have progressed over the last few years:

As a defensive and income-focused investor those results are exactly what I like to see; steady, progressive dividend growth supported by growing revenues and earnings (the dip in dividends between 2013 and 2014 was due to exchange rate movements as SABMiller sets its dividend in US Dollars).

Here’s how the company’s growth record stacks up against the market average (in this case the FTSE 100) in numerical terms:

- 10-year Growth Rate: 9.6% compared to 1.0% for the FTSE 100

- 10-year Growth Quality (i.e. consistency): 83% compared to 54% for the FTSE 100

So as the chart suggests, on the growth front SABMiller is clearly above average.

2. Is the company more profitable than average?

NO – I measure profitability using post-tax return on capital employed (Net ROCE), taking the median value over 10 years.

For SABMiller this profitability ratio is:

- 10-year median post-tax ROCE: 7.4% compared to 10.0% for the FTSE 100

Somewhat surprisingly (to me at least), SABMiller’s post-tax profitability is below average.

I have a rule of thumb which says don’t invest in companies where Net ROCE is below 7%. SABMiller is above that, so its profitability isn’t so low as to be a problem, but it will affect my estimate of what the company is worth.

3. Does the company have conservative financial obligations?

YES – By “financial obligations” I mean…