Every investor loves to own a multibagger - a stock that rises to become many times its original purchase price. The problem is that we often sell these positions too soon, before they have a chance to appreciate in value. If we don’t sell, we sometimes get too complacent and hold on to them for too long, only to watch our profits vaporise as the share price falls further down the line.

The author of Contrarian Investment Strategies, David Dreman, argues that ‘even amongst the professionals, few religiously follow their own sell rules’, while many private investors don’t seem to have any at all. Fortunately, Dreman offers a solution. Let’s take a closer look, and use a recent multibagger, Victoria PLC, as a case study to test Dreman’s approach.

Taking the 'Round Trip'

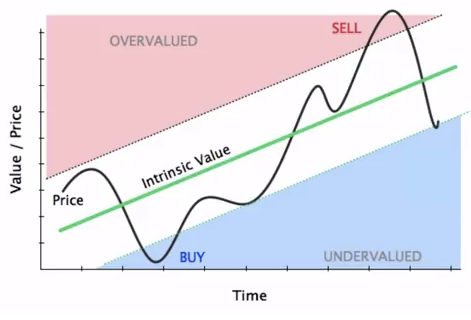

Benjamin Graham, the father of value investing and the tutor of Warren Buffett, argued that Mr Market (an allegory for the stock market) had manic-depressive characteristics, shifting from euphoric moods one day to depression the next. These mood swings are represented on the chart below, where the share price (black line) oscillates around the intrinsic value (ie. true worth) of a stock, which is more stable over time.

At the heart of value investing is the idea that investors should take advantage of Mr Market's mood swings and buy stocks when the share price falls below the intrinsic value. Investors should then sell when the price rises above its intrinsic value. This might sound straight forward, but David Dreman explains that ‘one of your most difficult decisions is when to sell’. It is sometimes tempting to hold onto stocks when they rise above their intrinsic value. Dreman observed that:

'If the stock was originally purchased at $20, with the sell target at $40, and it shot through $40, the manager would often bump the sell price higher. This frequently resulted in the manager taking 'the round trip': riding a stock all the way up, only to ride it all the way down again."

Mechanical Sell Rules to the rescue

To overcome this problem, David Dreman argues that investors should 'rely on mechanical guidelines, which filter out much of the emotional content of the decision.' Indeed, Dreman insists that investors should ‘pick a sell point when you buy a stock. If it reaches that point, grit your teeth, brace yourself, and…