For a long time Next was a stock market darling but now, thanks to a change in sentiment and some dramatic share price declines, the shares may at last be as attractive as the underlying company.

Next PLC is one of the UK’s most successful retailers, having shrugged off the Global Financial Crisis and Great Recession with relative ease. Even including those more than slightly negative environments, the company has managed to grow its earnings and dividends at double digit rates year after year.

However, all good things come to an end. In this case the CEO’s recent admission that “The year ahead may well be the toughest we have faced since 2008” did not go down very well with the market. In fact the only thing that did go down well was the share price; down 35% from a high of around 8000p to 5200p today.

So now that the shares are much cheaper than before, would I buy them? I think I might, and here’s why:

Impressive earnings, dividend and share price growth

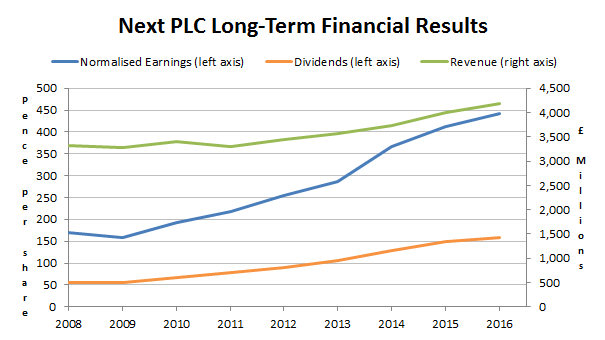

As I’ve already mentioned, Next has grown at double digit rates, as the chart below shows:

Per share earnings growth has been spectacular, but total revenue growth has noticeably lagged both per share earnings and dividend growth. I’ll explain why in a moment, but first, here are my key financial stats for Next, as compared to the FTSE 100:

- 10-Yr growth rate = 12% (FTSE 100 = 2%)

- 10-Yr growth quality (consistency) = 83% (FTSE 100 = 50%)

- 10-Year profitability (ROCE) = 43% (FTSE 100 approx. 10%)

(you can see how those metrics are calculated here)

Next’s profitability figure of 43% (based on return on capital employed) is a little misleading as the company rents rather than buys its stores, so the stores aren’t noted on the balance sheet as assets.

That makes the capital employed side of return on capital employed look smaller than it actually is, which in turn makes the percentage profitability figure higher than it actually is.

If I estimate the value of the company’s stores at eight-times their rental cost (read Richard Beddard’s brief explanation of “capitalising leases“ to understand why) then that adds about £1.6 billion of capital assets to the balance sheet.

That adjustment reduces ROCE down to about 20% on average, which…