In my personal portfolio, I hold shares in three of the big miners -- Rio Tinto, BHP Billiton and Anglo American. I didn’t catch the bottom when I bought originally, but I averaged down where possible. The dramatic recovery these firms delivered last year produced some respectable profits for my portfolio.

However, these big gains left me wondering whether I should trim my holdings as we headed into 2017.

In the end, I decided that the mining stocks I owned still looked fairly cheap based on historic measures of profit, such as the PE10. Each stock’s forecast P/E ratio was also quite reasonable, and broker forecasts were continuing to rise. So I decided it should be reasonably safe to ignore the price action seen in 2016 and continue to hold.

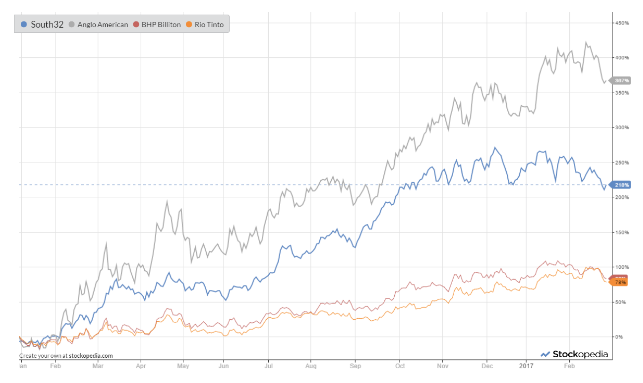

This is relevant today, because BHP Billiton spin-off South32 is up for consideration for the SIF Portfolio this week. This mid-cap miner lagged Anglo American last year, but outperformed both BHP and Rio by a considerable margin, as you can see from this chart:

New charts! I’d like to take a moment here to plug Stockopedia’s new charting system, which was released on Tuesday. It’s excellent and is a huge improvement on the old system. I’m not a technical investor, but I do find charts useful for gauging price trends and momentum.

If you haven’t seen the new charts yet, then take a look. They’re fast, detailed and highly customisable. You’ll find them on the charts tab on the StockReport pages, or by following Tools -> Stock Charts on the black navigation bar.

Is the mining party still going?

South32 was one of the first canaries in the coal mine this reporting season. The group reported its interim results on 16 February, ahead of BHP and Anglo.

Several years of cost cutting plus a sharp rebound in coal and iron ore prices delivered a comforting set of results, which I’ll look at in a moment. Stockopedia’s computers were also impressed. South32’s StockRank has risen from 66 to 86 over the last month.

The impact of these interim results has made South32 the top-ranked eligible stock in my SIF screen. So I need to decide whether to add this stock to the SIF portfolio this week.

Reassuring value

For a value investor who is fond of free cash flow, South32’s…