This week’s stock is a company I’ve never paid much attention to before. Aviation services group Air Partner has only recently crept over my £50m minimum market cap. But having done so it’s now qualified for my screen.

Should I add this small cap to the SIF Portfolio? My view on the airline industry is fairly cautious, but Air Partner seems to focus on niche areas where growth is continuing. The group is also diversifying through acquisitions.

What does Air Partner do?

If you’re not familiar with Air Partner, here’s a summary of the group’s activities:

- Commercial and private jet charter and leasing services

- Freight aircraft charter

- Aircraft remarketing services

- Travel agency services

- Training and consultancy

The company’s private jet clients are high-net worth individuals and organisations. Commercial jet customers include sports teams, the oil and gas industry and governments. For example, Air Partner won contracts to organise European flights for Leicester City and Manchester City during the first half of the year. Another specialty is government aid work, including emergency evacuation flights.

Where does the cash come from?

In terms of revenue and profit, the bulk of Air Partner’s income comes from its charter operations. During the first half of the current year, commercial, private and freight services generated an underlying operating profit of £3.8m.

These underlying figures must be stated before central costs, because the group’s underlying operating profit was only £3.0m during the same period. To give you an idea of the scale of the business, Air Partner generated revenue of £22.2m from transactions worth £112.9m during the first half.

Is Air Partner good value?

Let’s take a look at some of the numbers behind Air Partner’s outstanding StockRank of 99.

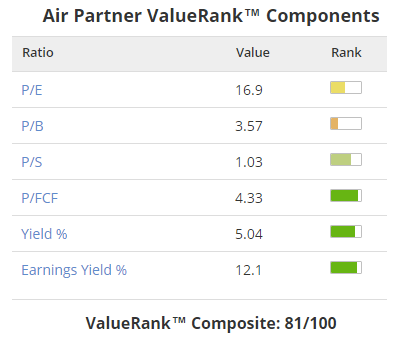

The group’s ValueRank of 81 is the lowest of its three QVM ranks, but doesn’t highlight any particular concerns, in my view:

There are some clear attractions. The group’s 5% dividend yield and 12.1% earnings yield are very appealing. The price/free cash flow ratio of 4.3 is even better, but is so low I decided I should take a closer look.

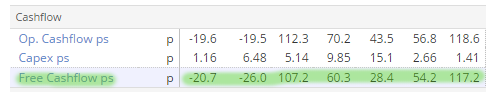

The Stockopedia data suggest that Air Partner’s cash flow is quite lumpy. That’s not surprising for a business of this type where large one-off contracts can skew results, but it’s worth bearing in mind:

Looking at the actual accounts, acquisitions and working capital movements have both had a big impact on cash flow over the…