A couple of weeks ago, I mentioned that I would be keen to add small cap fund manager Miton Group to the SIF Portfolio. On that occasion, Miton was outranked by XLMedia in my screen results. But things have changed. At the time of writing, Miton is now the highest-ranked stock in my screen which isn’t already in the portfolio.

This gives me a welcome opportunity to look more closely at this promising stock. While fund manager Gervais Williams is a key attraction, does it make sense to invest in a small fund manager at this point in time? Is the group in a position to deliver rising returns?

Has Trump hit the portfolio?

Before I look at Miton, I want to take a brief look at last week’s biggest story. I have to admit that I wasn’t really surprised that Donald Trump won the election. I was on vacation in the US in October, and the support I saw for Trump in small towns and rural areas of the north east was overwhelming.

Watching the US television coverage of the campaign felt very much like a rerun of Brexit. The issues and characterisations on both sides of the debate were much the same, just scaled up!

Getting back to the markets, the initial impact on the portfolio has been marginally positive. Trump’s pledge to boost infrastructure and defence spending lifted the portfolio’s holdings in Somero Enterprises, BAE Systems and John Laing. After a flying start, gold ended the week lower. Pan African Resources fell slightly as a result. The remainder of the portfolio was pretty much flat.

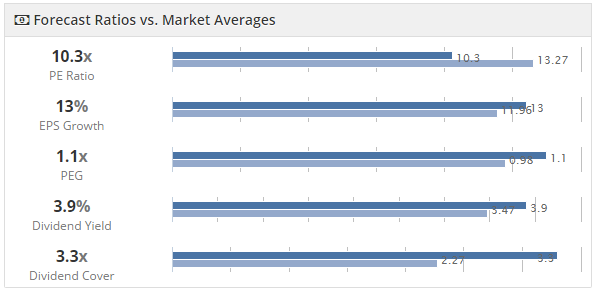

I remain happy with most of the portfolio, but it’s not always easy to measure whether a portfolio has the characteristics you’re targeting. Luckily, Stockopedia’s Folio system provides some excellent tools to help with this. One example is this snapshot, comparing key portfolio ratios with the market averages:

The dark blue lines represent the SIF Portfolio, the light blue is the market average. I think it’s fair to say that the portfolio is meeting its brief of “Affordable Growth. A blend of value, growth, quality and momentum.” The only area where I’m falling short slightly is the PEG ratio, which at 1.1 is slightly higher than the market average.

Let’s move on and take…