I’m writing this on Tuesday afternoon, after an action-packed morning for the SIF portfolio.

In this column I’ll take a look at the latest results from Norcros and at Go-Ahead’s costly year-end trading update. I’ll also follow up on the comments I made last week about the shortage of true defensive stocks in the portfolio. What kind of company are we missing, and why?

Norcros edges higher on solid results

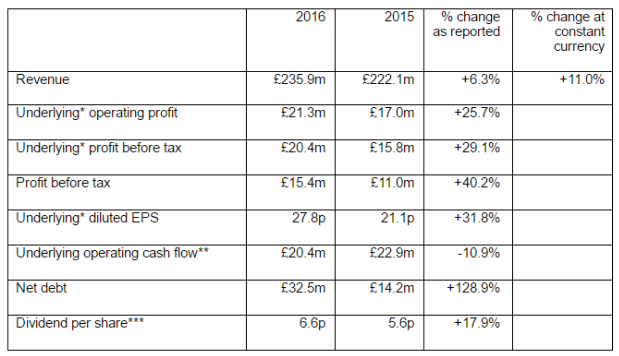

Tuesday was a down day for the markets. Bad news generated a much stronger reaction than good news. Recent portfolio addition Norcros headed into the close just 2% higher on Tuesday evening, despite reporting a 29% increase in underlying pre-tax profit, which rose to £20.4m.

Shareholder and small cap editor Paul Scott took a detailed look at yesterday’s results from Norcros. You can read Paul’s comments here.

I share Paul’s view that with a strong balance sheet and a P/E ratio of about 7, it’s hard not to see value in Norcros. The only thing I’d add to Paul’s commentary is to emphasise that free cash flow remains strong at Norcros. This is important, in my view.

When companies are growing by acquisition, management often gloss over poor cash flow. They may argue it isn’t representative of underlying or pro forma performance. It’s easy for investors to take a lax attitude in these situations, even though this can be a warning of problems to come.

The good news is that Norcros doesn’t appear to have any problems with cash flow. In my view, the group’s cash flow is very healthy. Stripping out acquisitions, free cash flow was £10m last year. That puts the stock on an underlying P/FCF of 10.8, pretty much unchanged from 2014/15. This sort of quality provides a real margin of safety and reinforces the buy case for Norcros, in my opinion.

Go-Ahead plunges, should I be worried?

Shares in SIF portfolio member Go-Ahead Group fell by about 15% on Tuesday, after the group warned that the profit margin over the life of its combined Thameslink, Southern and Great Northern rail franchise is now expected to be half the level originally forecast.

The collapse in the price of Go-Ahead’s shares would normally be associated with a profit warning. Effectively that’s what it was. While full-year adjusted profit guidance remains unchanged for 2015/16,…