Sky over Europe, football & mobile

Sky is the UK's largest pay TV network with 11.75m customers in the UK & Ireland at the end of 2014. The group is set to launch a UK mobile offering in 2016 and has retained the bulk of the UK Premiership football rights. Recent acquisitions have taken Sky into Germany and Italy and offer the prospect of subscriber growth from less mature pay TV markets.

Sky recently paid £1.4bn for the Premier League football rights which is 83% more than under its existing contract. With the top tier football clubs “coining it in" we are set to see more footballers driving Lamborghinis.

The impact on Sky's bottom line is in the opposite direction but the group will maintain its content leadership. This is crucial in pay TV where strong content attracts more subscribers which in turns allows more content to be bought i.e. a virtuous cycle.

The entrance of the UK telecoms gorilla, BT Group, into broadcasting has led to a bidding war for sports rights. In the long-term both BT and Sky look set to perform well with Sky maintaining its content leadership and BT focusing on offering subscriber value.

Both groups are also set to move into mobile with BT Group buying EE and Sky partnering with Telefonica UK (the owner of 02). Offering a broad array of services helps increase customer loyalty and generates economies of scale.

Moving into UK mobile

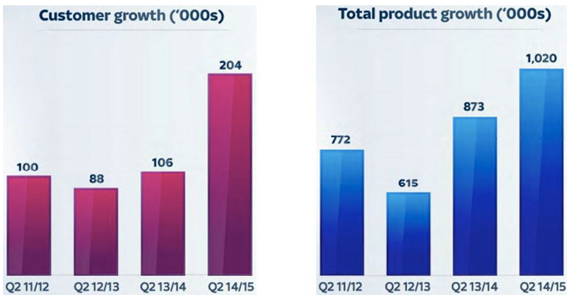

The December quarter saw the strongest customer growth for nine years in the UK and comes despite the entrance of BT Group into pay TV. As such the customer franchise remains robust and reflects market leadership in areas outside of sports and TV content.

UK churn in the December quarter fell to 9.2%, which is the lowest for over a decade, and comes as triple play reached 40% of Sky's subscriber base. Each Sky customer now takes on average 3.1 products which compares to only 1.2 in December 2006.

UK December quarter: subscriber momentum

Acquisitions have also taken Sky into Germany and Italy and provide the potential for long-term subscriber growth. Germany saw strong subscriber growth in the…