Sky’s new set-top box, Sky Q, launched in early February and includes a new interface, a new controller and “fluid viewing”. This should help to offset competition from new entrants like Netflix and Amazon Prime. Sky is seeing strong momentum in the UK & Ireland on the back of its content leadership.

Weak equity markets pushed the share price of Sky to its lowest level for a year last week at £9.76. With this well down on the high of £11.41 seen in July 2015 it is worth reviewing the investment case for the group.

Sky is no longer just a play on the UK pay TV market with the group having bought Sky Italia and Sky Deutschland in November 2014. However, the UK & Ireland generated nearly all of the profits in the six months to December 2015.

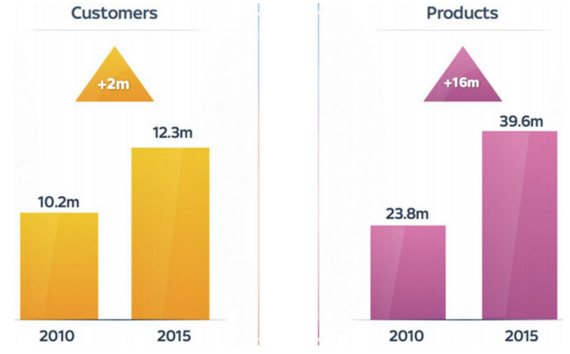

Sky has the dominant position in pay TV in the UK & Ireland with 12.3m customers at the end of 2015. This compares to 1.4m TV customers for BT Group and around 3.7m UK TV customers for Virgin Media.

Sky UK & Ireland subscriber numbers: pulling in the punters

Source: Sky investor presentation

Sky is also seeing good momentum with 205,000 new customers added in the UK & Ireland in Q2 – a 10-year high for the quarter. Customer churn hit a four-year low at 10.2% in Q2 and the TV customers in the quarter came in at 146,000.

Sky’s popularity clearly remains robust in its core market despite new competition from BT Group, Netflix and Amazon Prime. The launch of Sky Q should help the group to maintain its lead over the competition.

The new Sky Q set-top box

Source: Sky website

The takeover of Sky Italia and Sky Deutschland has hit profits in the short-term but as cost savings come through profit growth will return. Looking to the year to June 2018 and the forecast P/E is only 13.9X with a 3.9% forecast yield.

This falls to 10.9X for the year to June 2020 with the forecast yield increasing to 5.1%. The dividend yield is forecast 1.8X covered by profits in both while the ratios are based on Friday’s closing share price of £9.78.

Sky’s investment case and the competition

Sky is in the media sector but generates 86% of its revenue from customer subscriptions. This is a high quality revenue stream and means that…