Thanks to the woeful under-performance of smaller-cap stocks since March of this year, I have been thinking about constructing a small-cap income + growth portfolio, in much the same way as fund manager Gervais Williams is doing at Miton.

While the FTSE Mid-250 index has started to recover this year's losses (yellow line in chart below), both the Small-Cap and AIM 100 indices have yet to follow meaningfully - the FTSE Small-Cap index is still over 7% down from Jan 1, while the AIM 100 index is over 18% down.

It seems clear to me that there are currently a number of very attractive value opportunities in the small-cap space, so I wanted to construct a very simple screen to serve as a starting point for further research.

So I have extracted a preliminary list of smaller-cap higher-yield stocks drawn from the FTSE Small-Cap, Fledgling and AIM 100 indices using the following rules:

- Market cap over £10m (for a minimum level of liquidity);

- No foreign primary listed companies;

- A rolling dividend yield of 5% or over;

- Dividend cover of at least 1.4x;

- a Stockopedia QualityValue Rank of 90+.

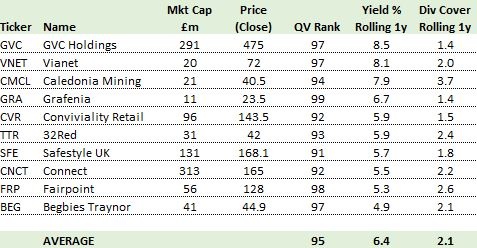

This is the list of 10 names I have come up with, ready for further research:

Interestingly, I already own or have owned in the recent past a number of these names; note that an equally-weighted portfolio of these 10 companies gives an average yield of 6.4%, covered over 2x.

I have already looked at, and like, the following companies on this list: Safestyle UK (LON:SFE), Connect (LON:CNCT), Fairpoint (LON:FRP) and Begbies Traynor (LON:BEG). I shall be looking in more detail into the other names in due course.

Edmund