Lo-Q (LON:LOQ) issues solid results for a "52 week and 6 day" financial period ended 4 Nov 2012 (unusual!).

Revenue rose 19% to £29.1m, and profit before tax was up 17% to £3.2m. This translates into basic EPS up 26% to 14.6p (EPS is flattered by a Corporation Tax charge which has fallen from 28.2% last year to 20.0% this year).

The year-end net cash pile of £8.9m has since been spent on the acquisition of an American company in a similar space, virtual queuing systems, called Accesso. That used up £4m of the cash, and incurred £4.0m in debt (which has been refinanced with Lloyds today, as planned), plus an additional payment made in 1.8m new shares. So they are effectively now more-or-less cash neutral.

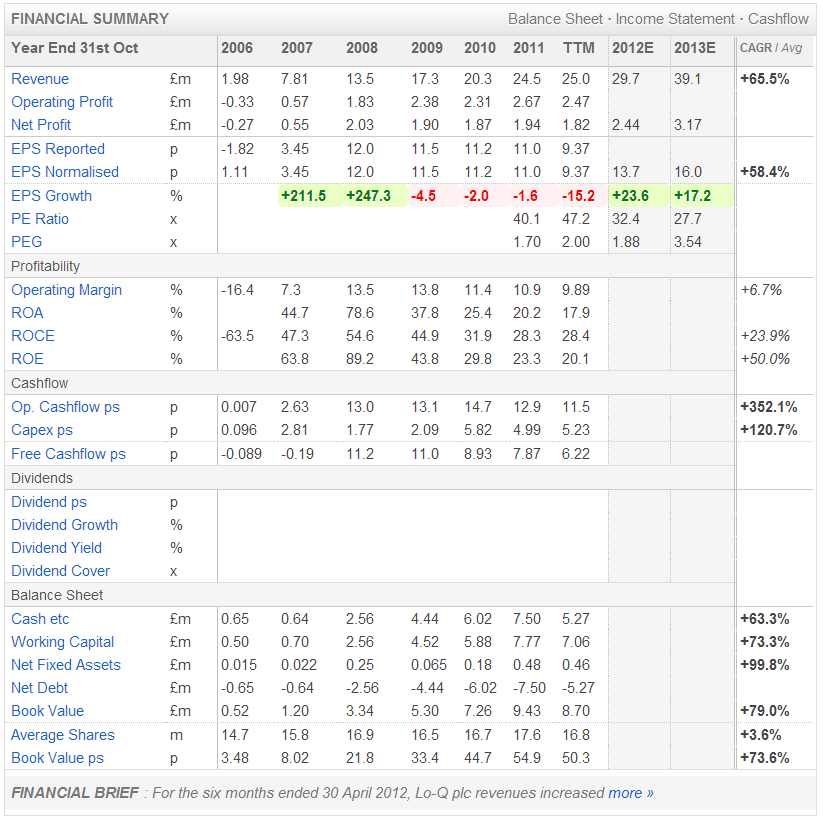

LOQ has clearly been a success story, as the historic data table below shows;

Interesting to note however that EPS has actually been flat from 2008-2011 at 11-12p. (please note that TTM is "Trailing Twelve Months")

That has jumped to 14.6p for 2012, and is forecast to grow again to 16p in the current year (ending 31 Oct 2013), fuelled by the acquisition of Accesso. There is no dividend.

I like the company, but remain sceptical about the elevated valuation. The market cap is now around £90m, or 3 times sales, at around 450p a share. I cannot see how this represents value at 31 times EPS just reported, and 28 times forecast EPS for the current year. But we are in a bull market, and valuations for growth companies are becoming pretty racy again, so who knows maybe the momentum will keep going here? To my mind a sensible price would be around 300p, or just under 20 times current year forecast EPS.

However, I also know how enthusiastic shareholders are about LOQ, and if you think they are likely to beat forecasts, then the numbers might stack up on a long term view at the current share price?

(Edit: new Edison research note on LOQ just published, click here to view it)

Nationwide Accident Repair Services (LON:NARS) issues a trading update today. They operate a chain of car crash repair workshops across the UK. Results for calendar 2012 are expected to be in line with market forecasts, which is for EPS of 9.9p, so the shares might seem good value at 70p. That's what I thought, until a reader kindly informed me that NARS uses a highly misleading (but legal) treatment of its large pension deficit, which magically turns a material liability into a fictitious asset. I find that outrageous, and complained to the Financial Reporting Council some time ago, asking for it to be investigated, but of course they didn't reply.

NARS reports a fall in the pension deficit to £22.7m, perhaps benefiting from the recent rise (from record lows) in Gilt yields? That is an interesting general point, in that we may now be over the worst for pension deficits, so companies with deficits could now be presenting investment opportunities rather than threats? Worth considering, on a case by case basis. It all depends on how material the pension deficit is to the company's market cap, and more importantly, its cashfows & cash balance.

The most interesting thing about NARS is its dividend yield, which at 5.5p offers a thumping 8% yield, althought the dividend has always looked at risk, given the pension deficit also requiring cashflow to plug the shortfall. I shall revisit this share once the results are issued on 9 April, and will take a view then, but it's the balance sheet that concerns me in the meantime, and how some investors might react when they see the restated accounts in April, showing a much weaker balance sheet than some might have thought. Although it amazes me how many investors don't even bother reading the accounts, or looking at the balance sheet at all.

Pawnbroker Albemarle & Bond Holdings (LON:ABM) reports a 31% fall in interim profits in the 6 months to 31 Dec 2012. I'm not comfortable investing in a business which makes money out of other peoples' misery, so will pass on this one.

Shares in Densitron Technologies (LON:DSN) have been hammered this morning, down 19% to 7.38p on a profits warning. There has been a delay in product deliveries (they develop electronic displays), and legal action over a property lease. The potential costs of the legal action are not stated, so that seems to me an essential piece of information to find out. They state their confidence for 2013, given that order intake in 2012 was up on 2011, so it does look like genuine delays in delivery times being the issue, rather than being used as an excuse for a bad year.

On balance I don't have time to look into the property lease dispute, so this share looks too messy for the time being. It is below my usual £10m market cap lower limit, but I mention Densitron because it came up in an article I wrote over the weekend about value stock screening - so looks like it was cheap for a reason! That said, timing delays to deliveries can just be a short term factor that provide bargain entry points, if everything else stacks up, so this could be an opportunity perhaps? Any views from readers who have looked into Densitron in more detail?

I've always liked small cap specialist engineering group Pressure Technologies (LON:PRES), but the ridiculous bid/offer spread, and lack of liquidity in the shares (the former causes the latter!) have prevented me from buying any. Pity, because their trading update today looks pretty solid. They report a, "positive start to the year" (ending 30 Sep 2013), and state that, "the Board is confident in the outcome for the current financial year".

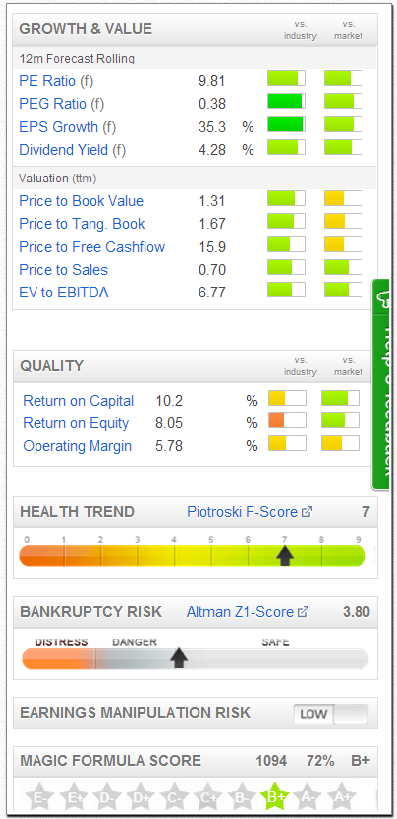

Here is the highly visual growth & value section of the StockReport from Stockopedia for Pressure Technologies (LON:PRES), which allows you to absorb the key strengths & weaknesses instantly, very handy when looking at lots of shares.

Given that analysts expect EPS of 16.5p this year, and 22.8p next year, that puts the shares (currently 193p) on a forward PER of 11.7 and 8.5, so the valuation looks reasonable for this year, and cheap if they deliver on next year's increased EPS forecasts.

Note that the 9.81 forecast PER shown in this table is weighted depending on how far the company is through its financial year. This makes all companies comparable on this measure - pretty nifty!

Also worth noting the 4.3% forecast dividend yield - as regulars know, I place considerable emphasis on good dividends, as not only do they give you a useful income whilst waiting for the shares to go up, a decent dividend is also itself a reason that new investors seeking income might buy the shares, hence making it more likely that the shares will go up.

A decent dividend yield also supports the share price, making a large downside move less likely, so lots of reasons for value investors to like dividends, especially in an ultra-low interest rate environment. But it's always essential to check how sustainable the dividend is. Any dividend yield over about 5% is potentially at greater risk of being reduced or cancelled.

Although we're now in a bull market, which is taking blue sky and growth companies onto much higher ratings. I don't believe in chasing highly rated shares to more & more stretched valuations, as that's really just a game of pass-the-parcel, hoping you can time your exit before the music stops.

Instead, I think it's better to look for undiscovered early stage growth stories, and jump in before the crowds, but only when market conditions are receptive to growth stories. That's exactly where the markets are now, so I'm shifting my focus slightly towards looking for some more speculative growth stories too, as well as my core value stuff.

So don't be surprised to see one or two more speculative investing ideas crop up here from now on! Although I remain anchored mostly in value. But a few GARP type situations (growth at reasonable price) will definitely crop up here as long as the market remains in bull mode. There might even be the occasional blue sky idea too, although I much prefer GARP as it's lower risk.

OK, that's enough for today. See you at the same time tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has no positions in any of them)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.